The Weekly Airdrop: 0x75

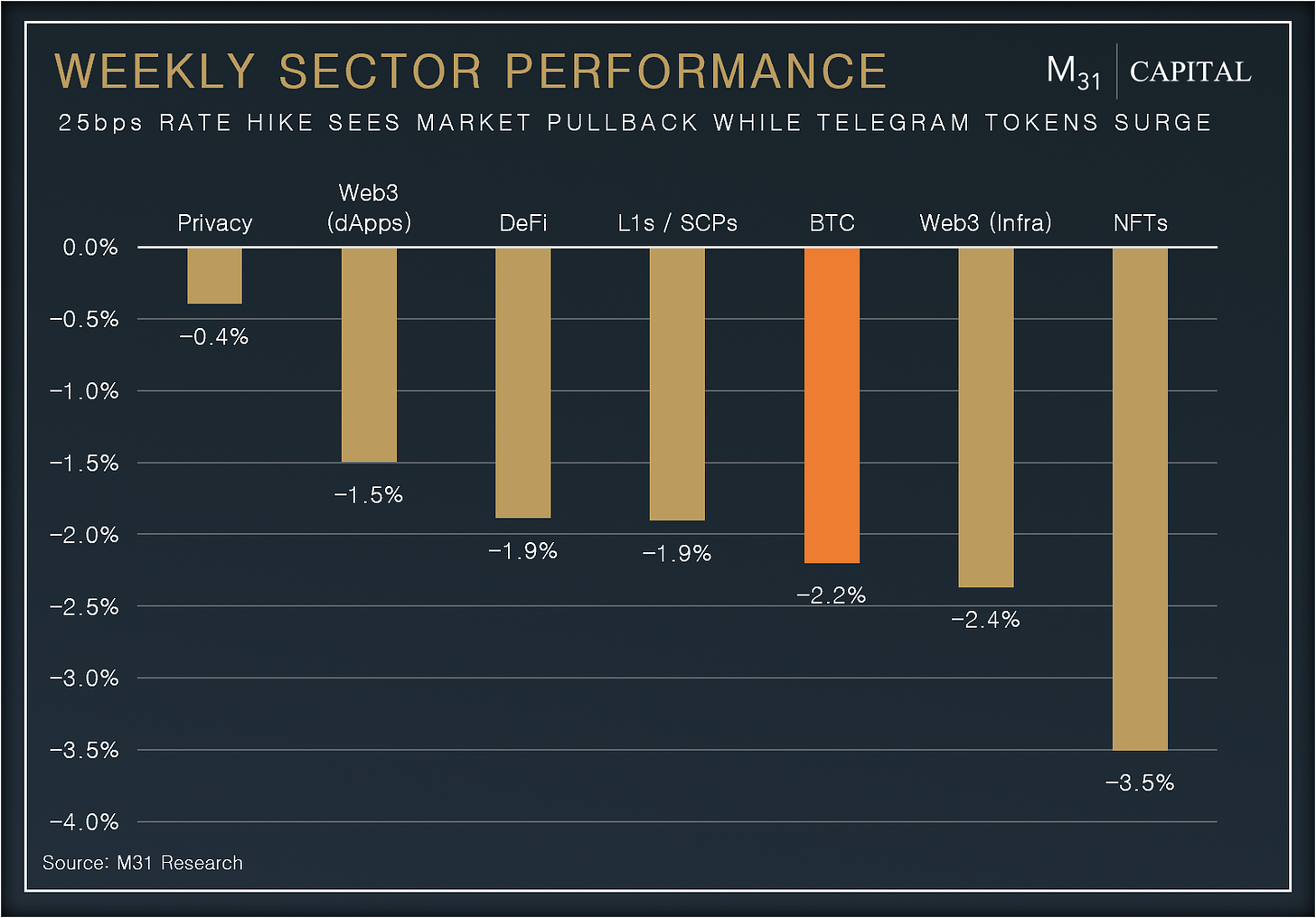

July 28, 2023 // Overall market (-2.0%): The Fed increased rates by 25 bps; Worldcoin launched at a $30B FDV; Telegram bot tokens surge; Synthetix is back among derivatives leaders

MARKET UPDATE

In terms of price action, its been a relatively “nothing to speak about” week. The overall market declined (-2.0%) in anticipation of the 25bps rate hike that we saw come through on wednesday. Since, then, it’s been rather quiet. We heard the same thing we’ve heard from Jerome Powell before; a reiteration of commitment to bringing inflation under 2%, future rate hikes will be data-driven, nothing new.

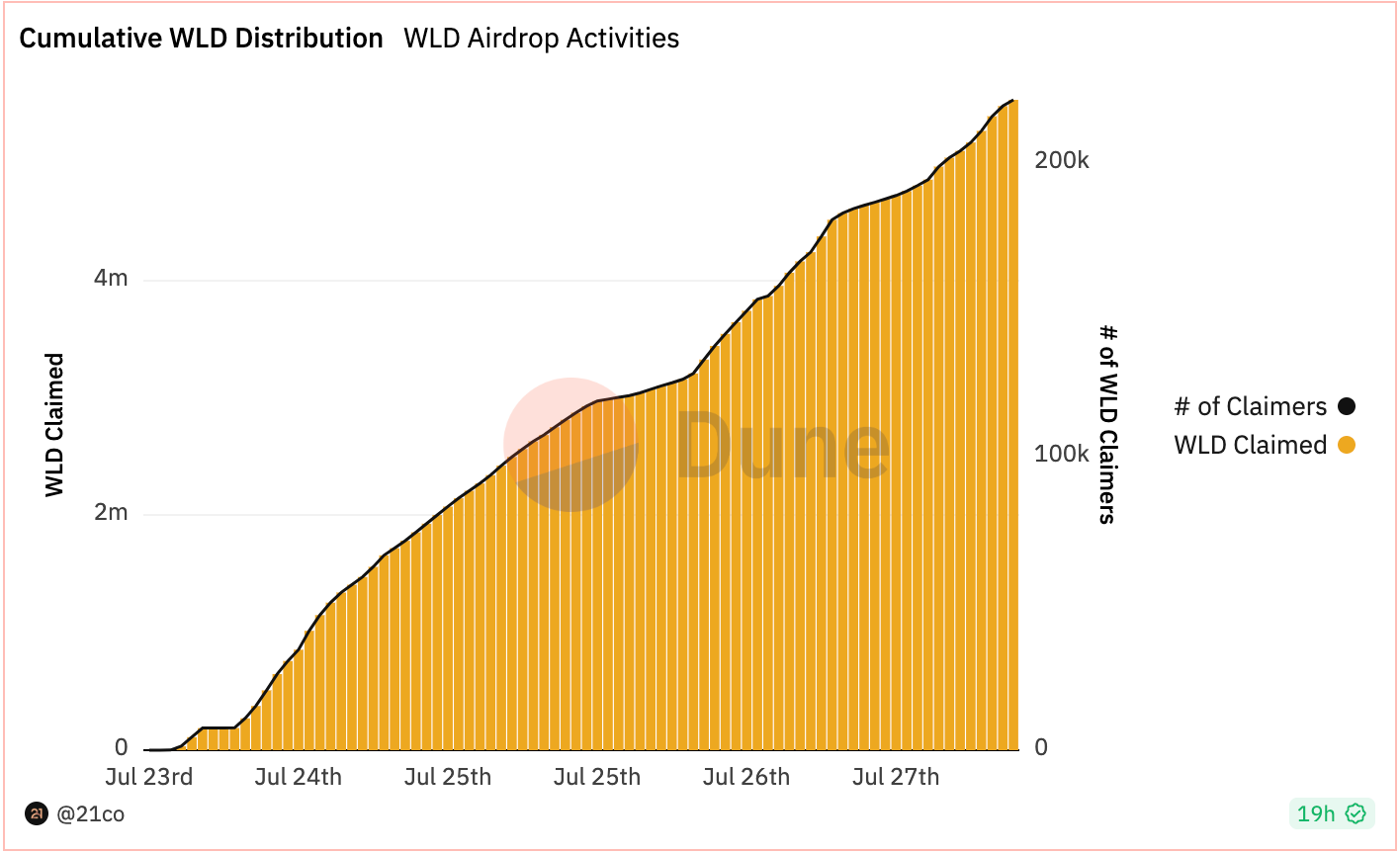

There was more interesting stuff happening in the crypto space as Worldcoin (built on the OP Stack) went live. Worldcoin, a hardware based biometric proof-of humanity solution, that gives users tokens in exchange for scanning their irises and proving they are human, has managed to stir up some good old fashioned controversy among the industry, especially after its token, WLD, launched at a ~$30B fully diluted valuation. A good, neutral take on biometric proof of humanity expressed here.

Telegram bots have emerged as a new meta capturing traders’ attention. While there are serious concerns around security (users don’t hold their own private keys), having telegram chats being an interface for executable onchain trades seems like a pretty intuitive UX upgrade. There’s also been alot of talk around Unibot revenues. While they may look impressive on paper, surpassing the likes of Synthetix and GMX, it is important to note that 85% of this revenue comes as a result of a “tax on trading the token”, and not from direct usage. Currently, speculation induced trading activity is inflating these revenue numbers, but as hype around the narrative dies, revenues should more reflect real usage.

We continue to see a growth in tokenization of offchain assets with Avalanche Foundation launching Avalanche Vista, a $50m initiative to pioneer offchain asset tokenization on their network.

DEFI OVERVIEW

Onchain Activity

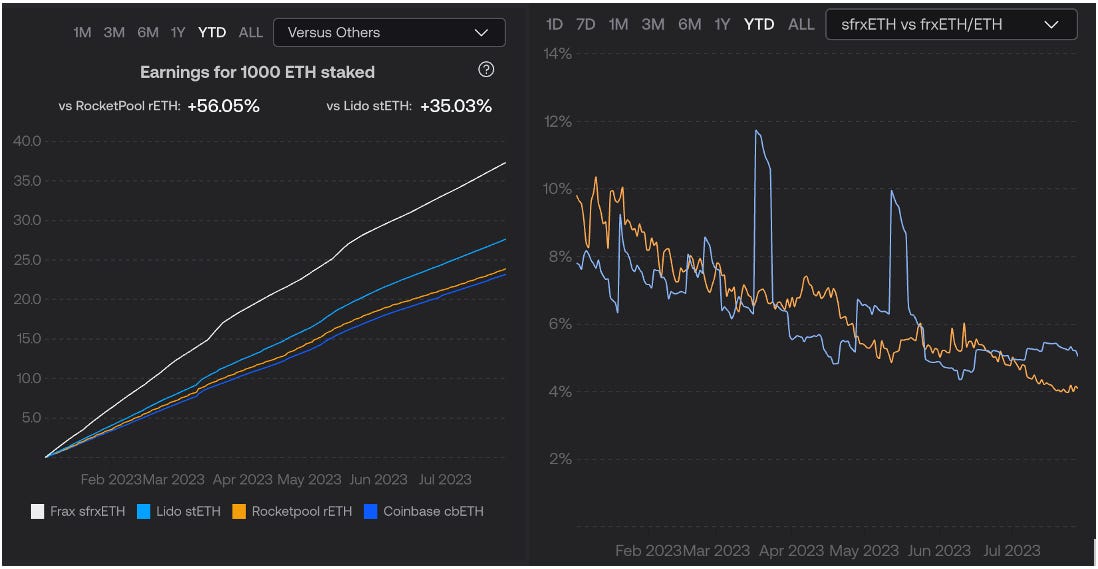

Frax’s sfrxETH yields continue to outperform it’s competitors stETH, cbETH and rETH, providing staking yields of 5.08%. YTD, 1000 ETH staked using Frax would have earned stakers 37.19 ETH, +56% more than rETH (23.91 ETH) and cbETH (23.19 ETH), and +35% more than stETH (27.52 ETH)

DeFi protocol revenues remain skewed towards derivatives DEXs and liquid staking protocols. Over the last 30, 60, 90 and 365 days, dYdX and Lido have been the top earners, raking in a combined $129.4m. All of these fees accrue to the protocol, and hence you will find Uniswap absent from this list

Offchain Activity

Gains Network announced upcoming upgrades to its tokenomics. They involve redirecting 100% of the dev fund revenue to GNS stakers, increasing the token supply by 4.36m tokens, and raising the revenue share to tokenholders up to 60% (currently, 33% of all fees go to GNS stakers)

Lybra, the leading "LSDfi" protocol with $381m in TVL, has revealed its ambitious vision for the v2 upgrade, poised to fortify the LBR token's long-term value. Noteworthy upgrade mandating users to lock 5% worth of their eUSD balance to earn esLBR rewards, along with a prolonged 90-day esLBR vesting period creating more demand and decreasing selling pressure as protocol issued $190m of eUSD, 5% of what can potentially lead to $9.5m of instant buying pressure for LBR

WEB3 OVERVIEW

Onchain Activity

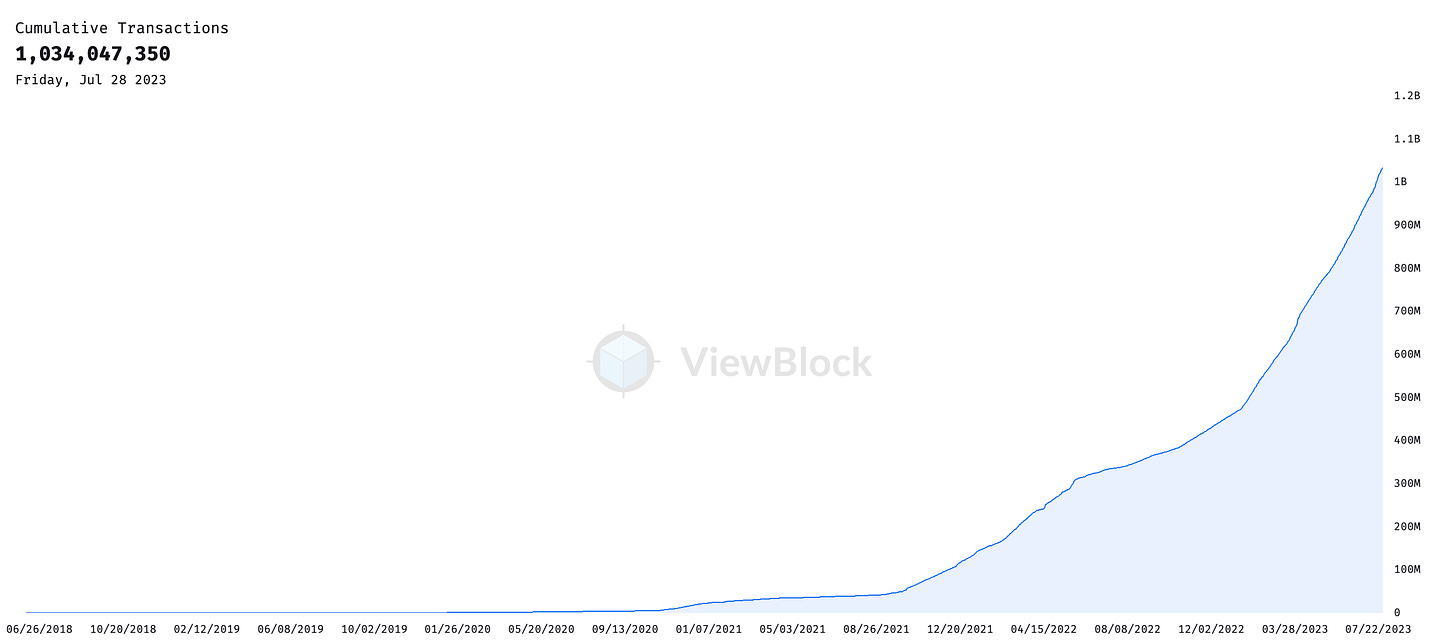

Arweave has been seeing increased activity, with active addresses up ~3x since March. Each transaction is essentially a piece of data stored on the network, and last week, the network crossed 1 billion total transactions, which means that over a billion pieces of data are now permanently stored, forever

zkSynk ERA is currently the “most active” rollup, witnessing a substantial increase in daily transactions, topping at 1.1m, +27.9% w/w and surpassing Ethereum's daily transaction count as well. Despite the recent $3.4 million exploit on EraLend, a leading lending protocol, activity on the zkSynk ERA network remains robust

Offchain Activity

Arbitrum Improvement Proposal #2 successfully passed, which will lead to improved support for account abstraction and smart contract wallets. The upgrade introduces features like using any ERC-20 token for gas fees, sponsored and batched transactions, and session keys. This development is will massively improve the UX of the L2

Optimism introduced their “Law of Chains” concept, a foundational step towards the superchain future for the OP Stack. It aims to create a unified collective of chains, governed by shared principles, promoting open, decentralized, and neutral blockspace

Protocol Highlight: Synthetix

Synthetix, is one of the oldest and most established derivatives trading protocols in the crypto space. Over the last year or so, Synthetix has seen a period where most of its volume had migrated over to GMX and dYdX. However, recent developments from the protocol have brought back users, and fundamentals are starting to look good again.

What to expect from Synthetix:

Synthetix v3 is going to bring upgrades to the protocol’s mechanics including: implementation of Liquidity Pools where LPs can borrow sUSD against their fee generating LP position, boosting capital efficiency. Perps v3 brings multi-collateral, as well as native cross-margin

CCIP integration enables secure cross-chain transfers of sUSD through the Synthetix Teleporter in the upcoming v3 upgrade, offering potential expansion opportunities across other rollups to capture more trade volume

Synthetix is building a perpetuals platform called 'Infinex' to rival CEXs and address existing limitations such as bridging to L2s, acquiring sUSD, and the need to sign every transaction. The New platform aims to allow users to sign up with a username, password and email

Performance metrics:

TVL reached $514.7m,+36% m/m, positioning them as 2nd largest derivatives trading protocol by TVL

Monthly trade volume hit $5.0bn, +125% m/m, which is second only to dYdX

Synthetix has generated ~$3.5m in monthly revenue, 100% of which is going to SNX stakers

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital