The Weekly Airdrop: 0x76

August 4, 2023 // Overall market (-1.1%): Curve Exploited; CRV and Related Onchain mayhem; Institutions filed for ETH Futures ETFs; We dive into Uniswap v4

MARKET UPDATE

The last week has definitely seen the focus shift onchain. All eyes were on Curve after some of its pools were exploited for ~$70m due to a bug in vyper contracts (more below).

The DoJ is reportedly contemplating fraud charges against Binance. However, they are hesitant due to potential impacts on consumers. This development has intensified the uncertainties surrounding Binance's future.

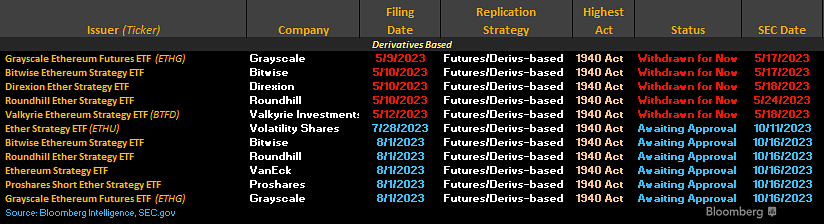

Despite the ongoing regulatory crackdown on cryptocurrencies, there is a clear indication of growing institutional demand for crypto assets. CME Group's addition of Ether/Bitcoin ratio futures to their crypto products lineup and the filing of six Ethereum futures ETFs by leading firms demonstrate this trend. Additionally, MicroStrategy acquired 467 BTC in July, and along with its plans to sell up to $750 million of stock, for new BTC purchases

DEFI OVERVIEW

Onchain Activity

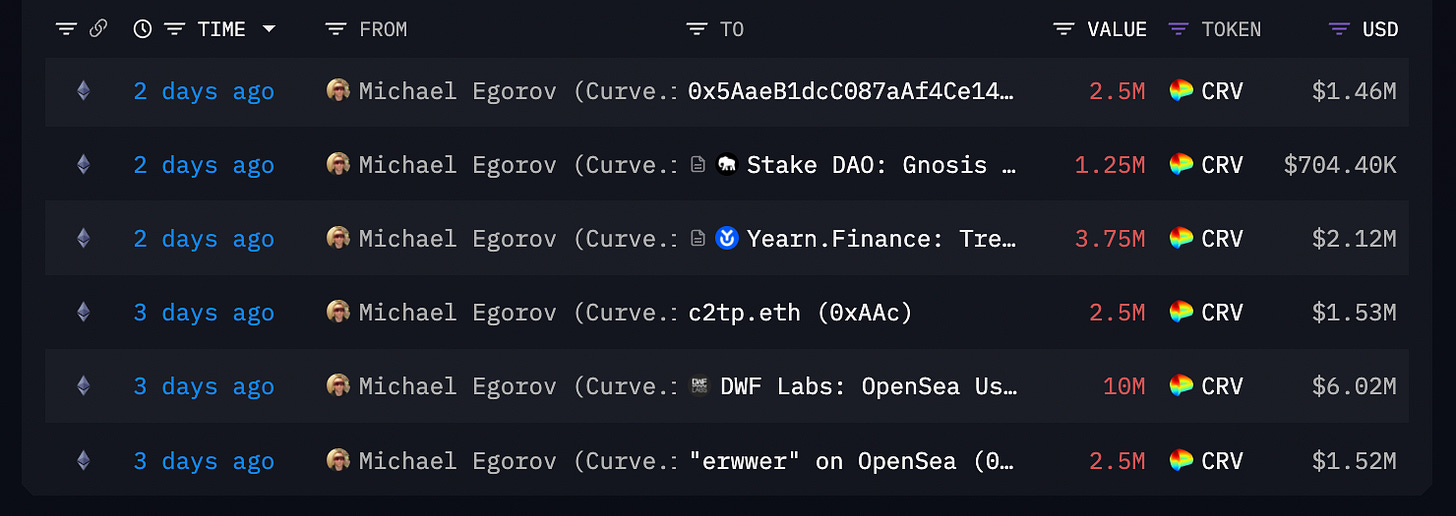

Curve: There was a ton of activity that happened onchain as a result of Michael Egorov’s onchain debt positions. He had ~$100m in onchain loans backed by ~$427.5m worth of CRV collateral.

The first domino to fall was a ~$70m exploit of some Curve pools. While the exploit itself was not that bad, falling CRV prices put the broader DeFi ecosystem into threat

Abracadabra, Aave & Frax, housed most of the debt, and were at risk, as there wasn’t enough CRV liquidity to liquidate Michael’s debt positions

This put severe pressure on CRV (-21.1%) and traders took large short positions on CRV, with OI peaking at ~$130m

Michael incentivized a gauge for people to deposit liquidity into the CRV/FRAX pool on Fraxlend and hence, decrease his borrow utilization rate. This worked and also highlighted the benefits of Frax’s isolated lending pool mechanism design

Michael managed to sell ~106m CRV tokens OTC (at a discounted price of $0.4) to various actors within the DeFi ecosystem, including Wintermute, DWF Labs, Cream Finance and paid back some of his debt, bringing his onchain liquidation price below $0.3, easing sell pressure on CRV and temporarily resolving the situation

Offchain Activity

Trader Joe's recent release on Arbitrum and Avalanche brings support for onchain limit orders, featuring two types: place orders and pool orders. This expansion enables new trading and liquidity strategies on DEXs, including options-like DCA, automated swaps at desired price points, and grid trading strategies

Aave governance is considering setting the CRV LTV to 0% in order to prevent additional borrowing against existing CRV collateral and mitigate the risks associated with bad debt, particularly due to $49.2m USDT loan borrowed against $152m worth of CRV as collateral by the founder of Curve

WEB3 OVERVIEW

Onchain Activity

Helium’s HNT token went through its halving on Aug 1st, decreasing HNT emissions to ~41.6k daily. The halving does not affect the cost of transmitting data on the Network as data credits are fixed to a US dollar value

Akash sees a sharp increase in resources providers +31.5% w/w to 50 prior to mainnet upgrade which set to go live in August with the support of its GPU market

Offchain Activity

Coinbase is actively exploring the integration of the Lightning Network as a scaling solution for Bitcoin. The company is seeking the best way to implement this technology to enhance the scalability and efficiency of Bitcoin transactions on its platform

Celo has recently onboarded Google Cloud as one of its network validators. To facilitate a smooth and speedy transition to the Ethereum ecosystem, cLabs plans to utilize Google Cloud's Blockchain Node Engine, a fully managed service for hosting nodes, as part of their strategy

Protocol Highlight: Uniswap v4

Uniswap v3, launched two years ago, revolutionized AMM design by improving capital efficiency and reducing slippage through it’s concentrated liquidity model. However, this upgrade came with tradeoffs like higher fees and increased code complexity. As the DeFi landscape evolves, Uniswap introduced v4 to address certain issues from v3 and to enhance the protocol's capabilities.

v4 architecture:

Hooks: contracts that run at various points of a pool action's lifecycle which allows the pool deployers to introduce code that performs a designated action at key points throughout the pool’s lifecycle like, before or after a swap, or before or after an LP position is changed

Singleton Contracts: where all pools live within a single smart contract, basically unifying the liquidity for more efficient routing, drastically reducing costs of deployment as well

Flash accounting: assets are no longer transferred in and out across the pools after each swap, instead, the system transfers only on net balances, decreasing further the gas consumption

The combination of Hooks and Singleton is expected to be up to 99% more gas efficient than v3 as swaps will no longer need to transfer tokens between pools held in different contracts

Potential new features allowed by v4:

A time-weighted average market maker (TWAMM)

Dynamic fees based on volatility or other inputs

Onchain limit orders

Depositing out-of-range liquidity into lending protocols

Customized onchain oracles, such as geomean oracles

Auto-compounded LP fees back into the LP positions

Internalized MEV profits distribution back to LPs

Performance metrics:

Monthly trade volume in July was $24.9bn, -20.4% m/m

Despite the decrease in volume, DAUs remain at historically high levels of ~89.0k, +204.7% y/y

Cumulative fees generated by Uniswap over past year crossed ~$587m

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital