The Weekly Airdrop: 0x77

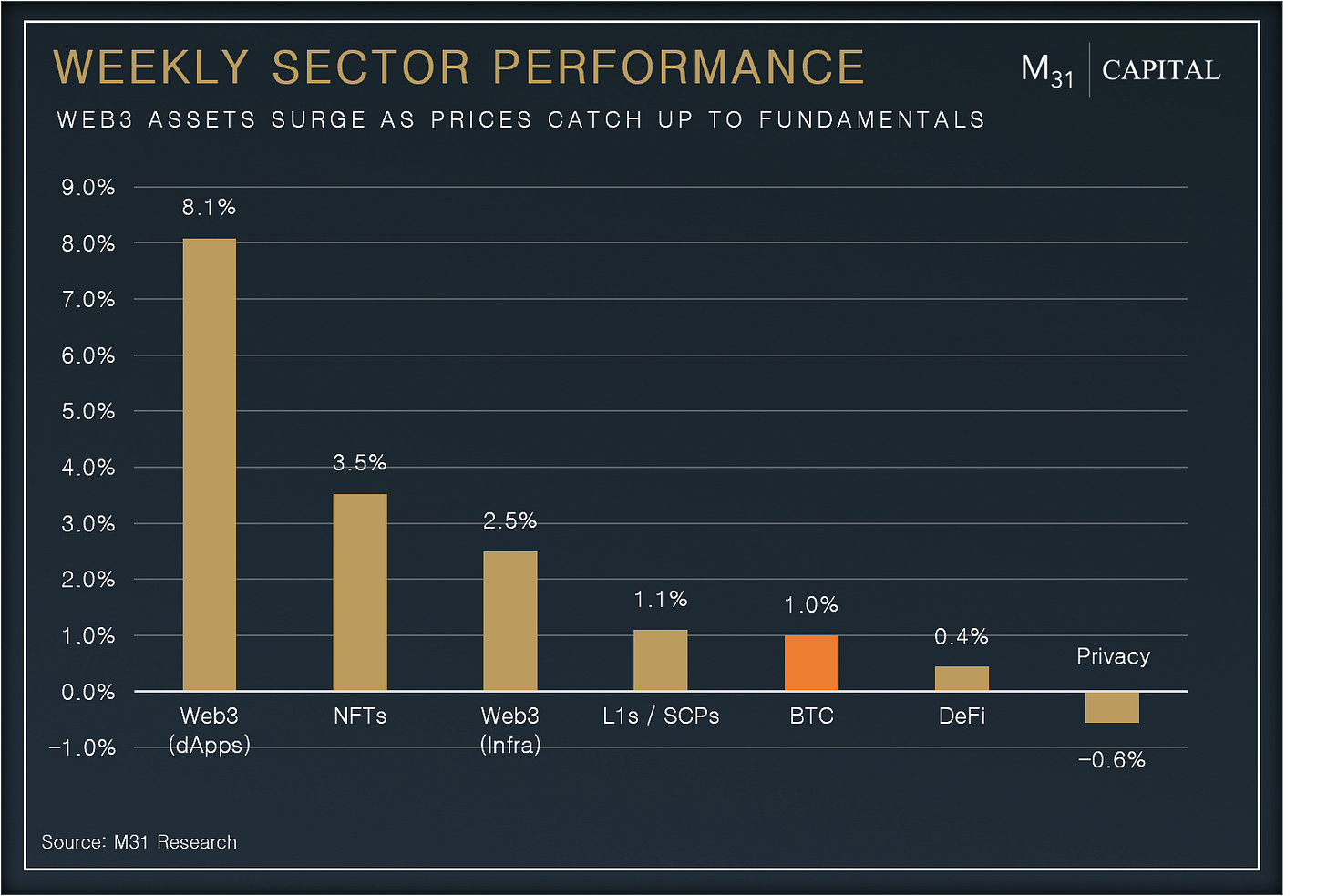

August 11, 2023 // Overall market (+1.2%): Base "officially" launches ; Gambling tokens rally; AKT & LPT outperform; PayPal launches PYUSD

MARKET UPDATE

Another week, and again, the market doesn’t seem to be giving too much away. BTC (+1.0%) & ETH (+1.0%) had another quiet week, as CPI rolled in at +3.2% YoY for the month of July, more or less in line with expectations. The lack of liquidity is quite telling right now.

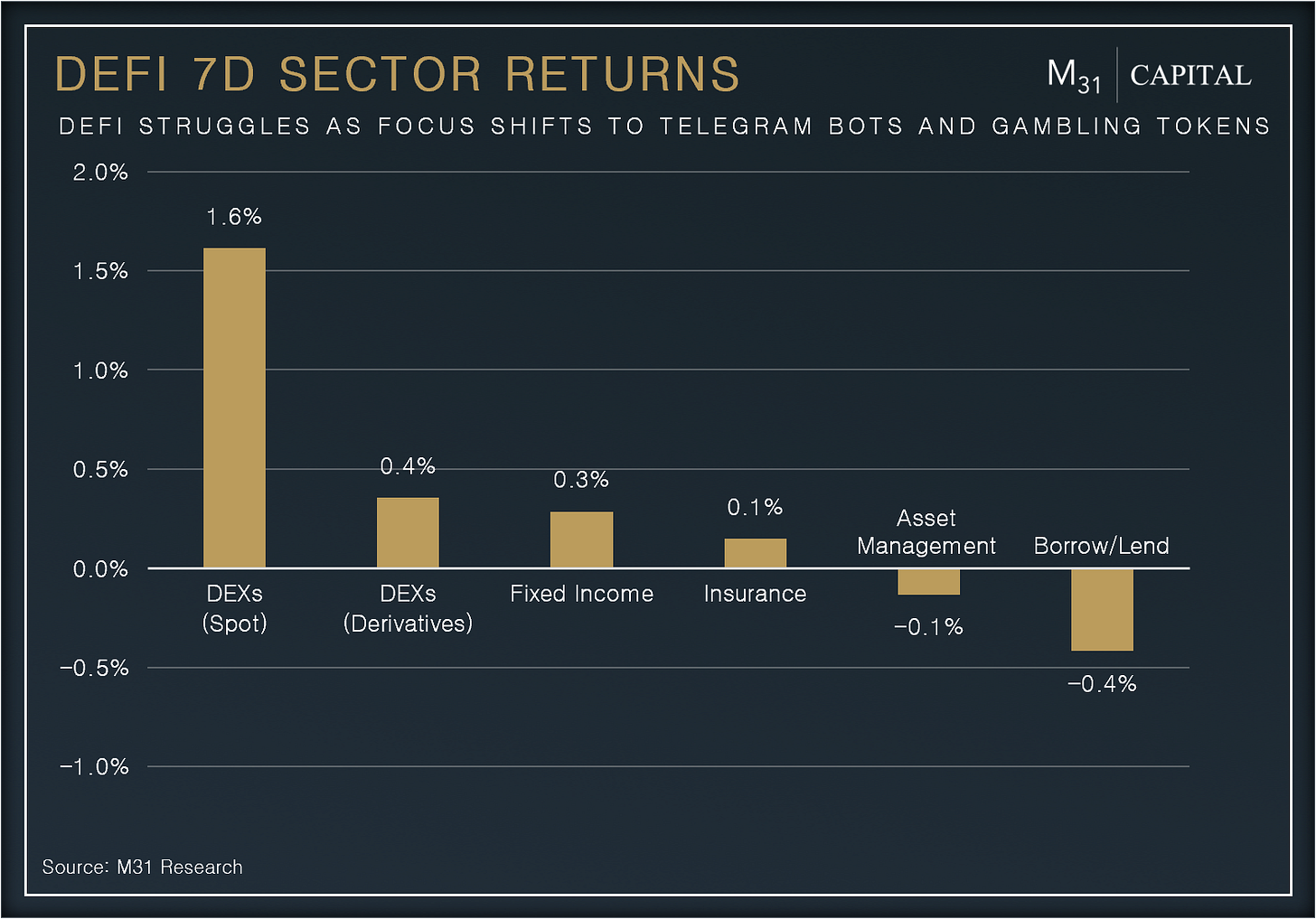

Most of the focus in current markets seems to be on Rollbit, especially after the platform announced that it would be sharing revenues with RLB holders through a buyback and burn mechanism. RLB ended the week +73.6%

In the stablecoin space, MakerDAO has been adopting strategies to aggressively grow DAI supply, with decent success so far, with DAI supply +15.2% over the last week, and PayPal announced that they would be launching their own stablecoin, PYUSD which will be backed by secure and highly liquid assets.

DEFI OVERVIEW

Onchain Activity

DAI supply surged to $5.1bn, +15% weekly increase, attributed to the introduction of an attractive 8% yield through Spark Protocol’s Dai Saving Rate (DSR), that will be sustained through Maker revenues, which stand at ~$90m annualized

While zkSync’s TVL ($143.1m) and transaction activity (200k-300k daily) have skyrocketed over the last few months (driven by airdrop farmers), it is quite interesting to note that since April, zksync has been outperforming both Arbitrum and Optimism in terms of pure profit earned, & over the last 30 days, zkSync has earned $7.5m, up +17.9% over the previous month

Offchain Activity

FIP-277 proposes onboarding FinresPBC as an offchain partner for introducing RWAs to FRAX v3, pending support from the community

Maple Finance plans to extend access to its Cash Management pool to accredited investors in the U.S. Through a Regulation D exemption, this offering aims to provide entry to Maple's Cash Management pool for high-net-worth individuals, crypto funds, DAOs, Web3 startups, and other eligible investors. This move seeks to expand the reach of Maple Finance's offerings to a broader spectrum of qualified market participants

WEB3 OVERVIEW

Onchain Activity

Helium sees a surge in revenue +59.1% over past 30d to $119.7k as network usage in USD continue to grow reaching $4k daily, +479.7% m/m, majorly driven by IoT devices on the network

Livepeer's daily revenue has demonstrated steady growth throughout August, hitting a three-month peak of $1.4k. This progress can be attributed to Livepeer's growing integrations, including the one with Base, where it hosted the onchain Summer event and provided daily streaming services through LensPlay, a video-centric mobile application

Offchain Activity

Offchain Labs Launches BoLD, A Permissionless Validation Protocol For Arbitrum On Ethereum bringing greater decentralization and security to the platform. While the details on validators’ rewards has not disclosed yet, that might include sharing the part if network revenue

Approximately $170m worth of unlocks are expected to enter the market in the next few days, with approximately $133m worth of SAND tokens scheduled to be released on August 14th

Protocol Highlight: Akash Network

Akash Network is a decentralized cloud computing marketplace that allows users to rent computing resources from providers in a secure and transparent manner. It is built on the Cosmos SDK and uses a Proof-of-Stake consensus mechanism.

Akash’s AI Supercloud

Akash 2.0 proposal is set to go live in Aug introducing the AI Supercloud, Akash's decentralized cloud computing platform that is specifically designed for artificial intelligence (AI) workloads. It offers a number of features that make it ideal for AI, such as:

High-performance GPUs: The network will provide an access to high-performance GPUs, which are essential for training and deploying AI models

Efficient pricing: Due to auction based pricing mechanisms, Akash provides resources for lower than traditional cloud computing platforms. This makes it more affordable to train and deploy AI models

Decentralization: The AI supercloud is a decentralized platform, which means that there is no single point of failure. This makes it more secure and reliable than traditional cloud computing platforms

“AI-Supercloud” will be integrated with more AI frameworks, such as TensorFlow, PyTorch, and Keras. This will make it easier for developers to use the it for their AI projects

Akash 2.0 Milestones:

GPUs market testnet has been running for several months including such steps like attracting the providers of NVIDIA H100s and other high-performance GPUs

Numerous models like Llama 2, Meta's latest 70 billion parameter LLM, successfully deployed on Akash GPU Testnet

Akash has partnered with Together, a company that provides GPU-as-a-service solutions. This partnership will allow Akash to offer high-performance GPUs to users of the #AISupercloud

Performance metrics:

Over 1,300 participants signed up to stress-test the network across a range of AI deployments and benchmarks during GPUs Testnet

Amount of CPUs leased is actively growing prior to Akash 2.0 to 923.5 CPUs daily, +71.5 % YTD

Total network CPU capacity reached 2.9k CPUs with network utilization of 31.6%

AKT staking ratio reached 67.8% with 142.6m AKT staked - one of the highest across PoS blockchains

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital