The Weekly Airdrop: 0x80

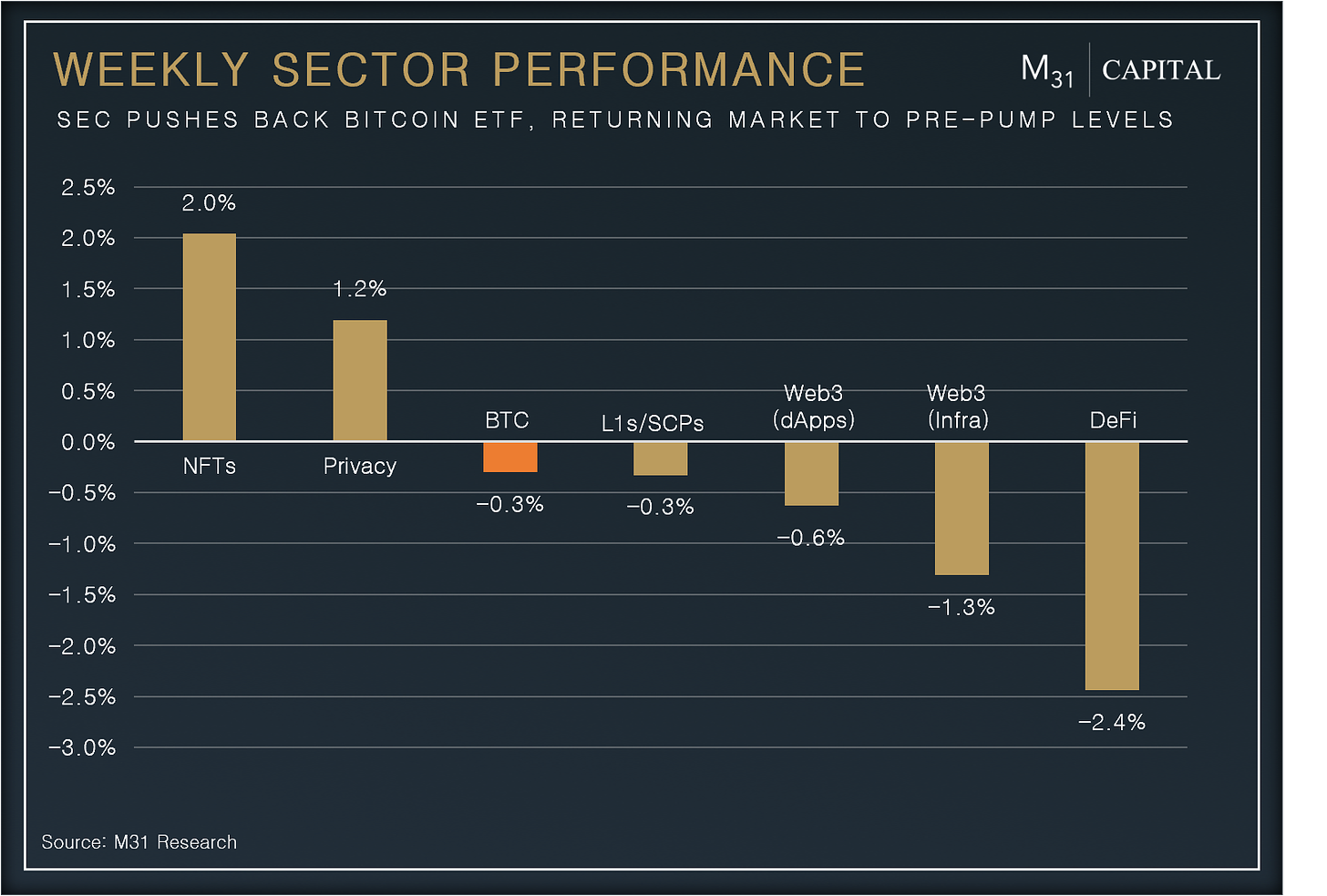

September 1, 2023 // Overall market (-0.2%): Grayscale wins SEC court case but Bitcoin spot ETFs delayed; China crypto makes a comeback and DEX usage climbs

MARKET UPDATE

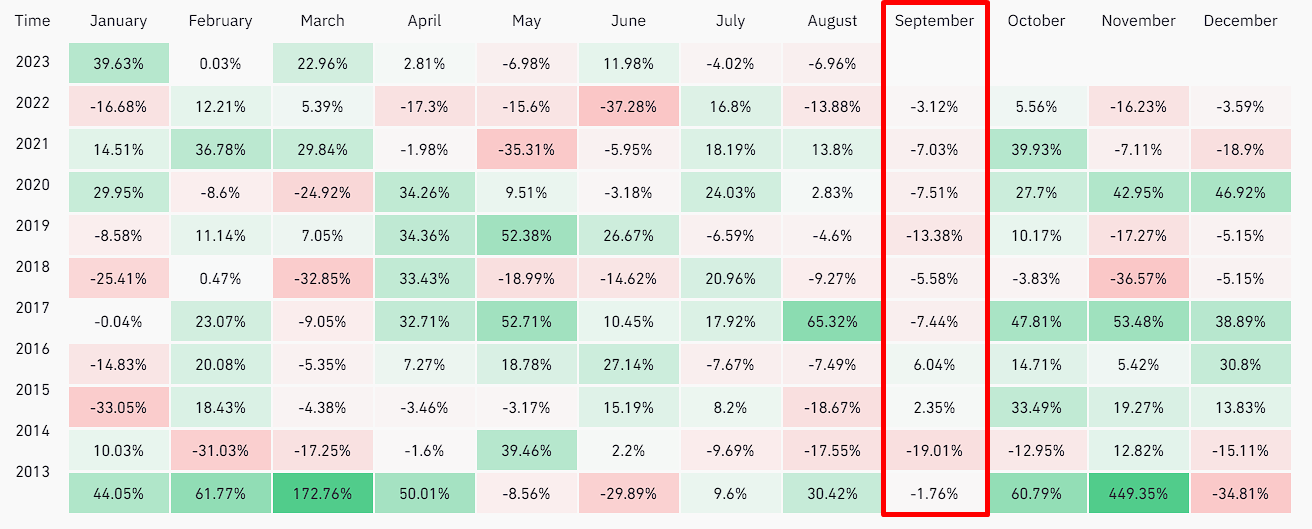

We're officially in the longest bear market in crypto history, and the market is entering what historically has been the worst month for Bitcoin. Despite this, Crypto and BTC have had massive wins in courtrooms across the United States this month.

We’ve spoken at length about the Grayscale decision so lets turn to the other consequential case: Uniswap. This case sought to impose punitive damages against the Uniswap AMM for allowing users to purchase tokens they had lost money on. Given the permissionless nature of the software, anyone can list a token so token issuers are not always known. The court ruled in favor of Uniswap as they cannot be held liable for how other people use their code (which is open source). This sets an important precedent for decentralized protocols in a similar manner to the Protection of Lawful Commerce in Arms Act (2005). “Our laws should punish criminals who use guns to commit crimes, not law-abiding manufacturers of lawful products.”

Historically, September has been a tough month for BTC, posting a loss for 8 of the last 10 years on record. Will September 2023 see similar results? The market is stagnating as the supply of stablecoins continues to shrink, tightening liquidity while the Fed is likely to increase rates by another 0.25bps, accelerating the migration of stablecoins into USTs.

Alongside this, Bitcoin rallied this week (+8.1%) following Grayscale's victory over the SEC in the ETF case, rendering previous reasons for the SEC's decline of Grayscale and other ETFs worthless and immediately returned to pre-pump levels as SEC delayed all existing ETF applications.

While the SEC could defer its decision, the general sentiment is that there's a 75% probability of eventual ETF approval. September is equally significant for the ETH futures ETF, with a decision expected from the SEC on September 16th. Although less impactful for the market than the BTC spot ETF, its approval could pave the way for the ETH Spot ETF application.

Institutions are actively engaged in this landscape. Robinhood's wallet has accrued $3.2B worth of BTC evidently leading the ETF decision race. BlackRock has amassed the largest position across 4 major Bitcoin mining firms, holding a total of $0.4B

This week, China officially (re)entered the realm of real crypto trading. Twitter's X also entered the arena, applying for a crypto payments and trading license. Given X has 450m MAU, this presents the possibility of a substantial influx of new crypto users.

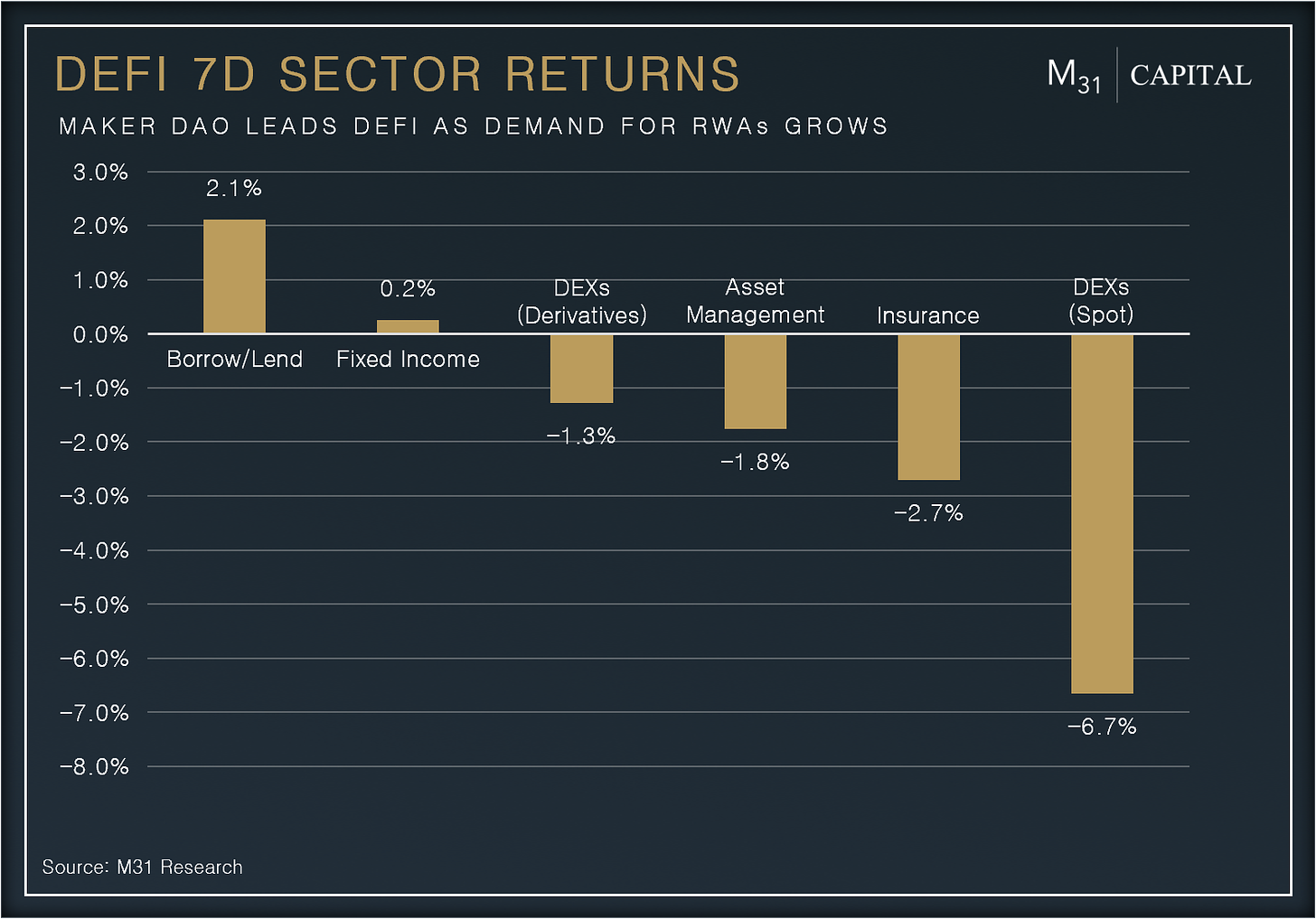

DEFI OVERVIEW

Onchain Activity

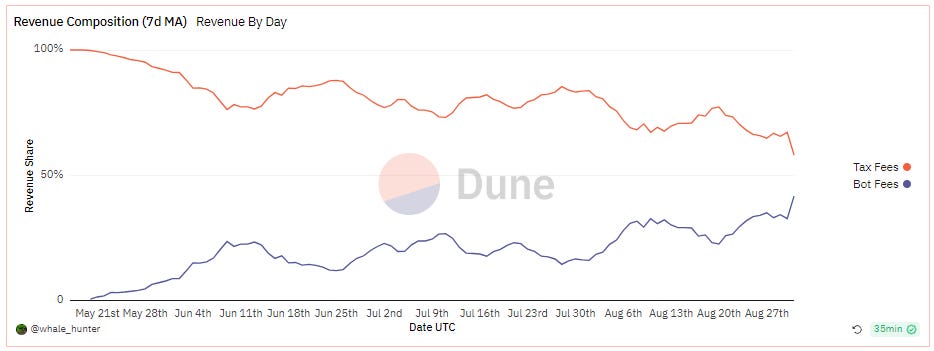

Unibot continues gaining traction, with its revenue gradually on track to be usage dominated. Bot fees now account for 41.8% of total revenue. The user base is loyal, reaching an ATH of 2.1k daily active users, 87% of whom are returning users. Weekly trade volume hit an ATH of $9m after expanding to Base

Pendle’s TVL is up +17.8% w/w, aiming to surpass recent ATH of $192.9m. Within a week, it attracted $16.7m worth of RWA assets (sDAI and fUSDC), allowing users to speculate on or lever up yield. RWAs are a lifeline for DeFi in the current market state bringing non-inflationary, stable yield onchain

Offchain Activity

Stroom Network secures $3.5m for Bitcoin 'liquid staking' on Lightning and introduces lnBTC derivative token on Ethereum. Users can earn routing fees by depositing bitcoin on Lightning, while Stroom issues lnBTC on Ethereum, maintaining a 1:1 bitcoin peg. This allows users to explore yield opportunities in the Ethereum ecosystem, while receiving yield from Lightning

Lido together with Neutron and Axelar are working together to bring wstETH to Cosmos. Together with dYdX’s migration to Cosmos, this should significantly boost the Cosmos DeFi ecosystem

WEB3 OVERVIEW

Onchain Activity

Livepeer has been a big winner of Base's Onchain Summer events, with August fees hitting a YTD peak, growing +27.9% monthly. Livepeer's expansion includes the Delta - Public Goods Funding program, channeling LPT emission to a treasury for DAO distribution which is set to go live on September 15h

ENS revenue is +42.1% to $2.0m reaching 5 months high after ENS integrated DNS, enabling them to be utilized as Web3 usernames essentially becoming the name service of the internet. The growth of the revenue caused by new name registrations spiked in August to 43.1k, +39.6% m/m

Offchain Activity

Robinhood expands Web3 wallet functionality to include Bitcoin and Dogecoin custody, transactions, and receipts. The platform also introduces in-app swaps on the Ethereum network, accessible to some users for over 200 tokens from Wednesday onwards

Akash Mainnet 6 upgrade was successfully completed bringing Nvidia GPUs to its decentralized compute market. The upgrade focuses on providing users access to Nvidia GPUs for compute-intensive workloads. The importance of this is hard to underrate as compute powers is the most valuable asset in AI powered world

Sector Highlight: DEXs

Onchain Summer. This is what we’re calling this phase of the bear market.

It is not entirely unlike prior phases, where CEXs were ghost towns, liquidity was dry, and there was no real interest in crypto, or tokens. What’s different about this time?

This time, there is activity. You won’t find it on CEX order books. You’ll find it onchain. While liquidity, and trade volumes have fallen from their mighty peaks in 2021, DEXs continue to spur on the onchain movement, one swap at a time.

Key Insights:

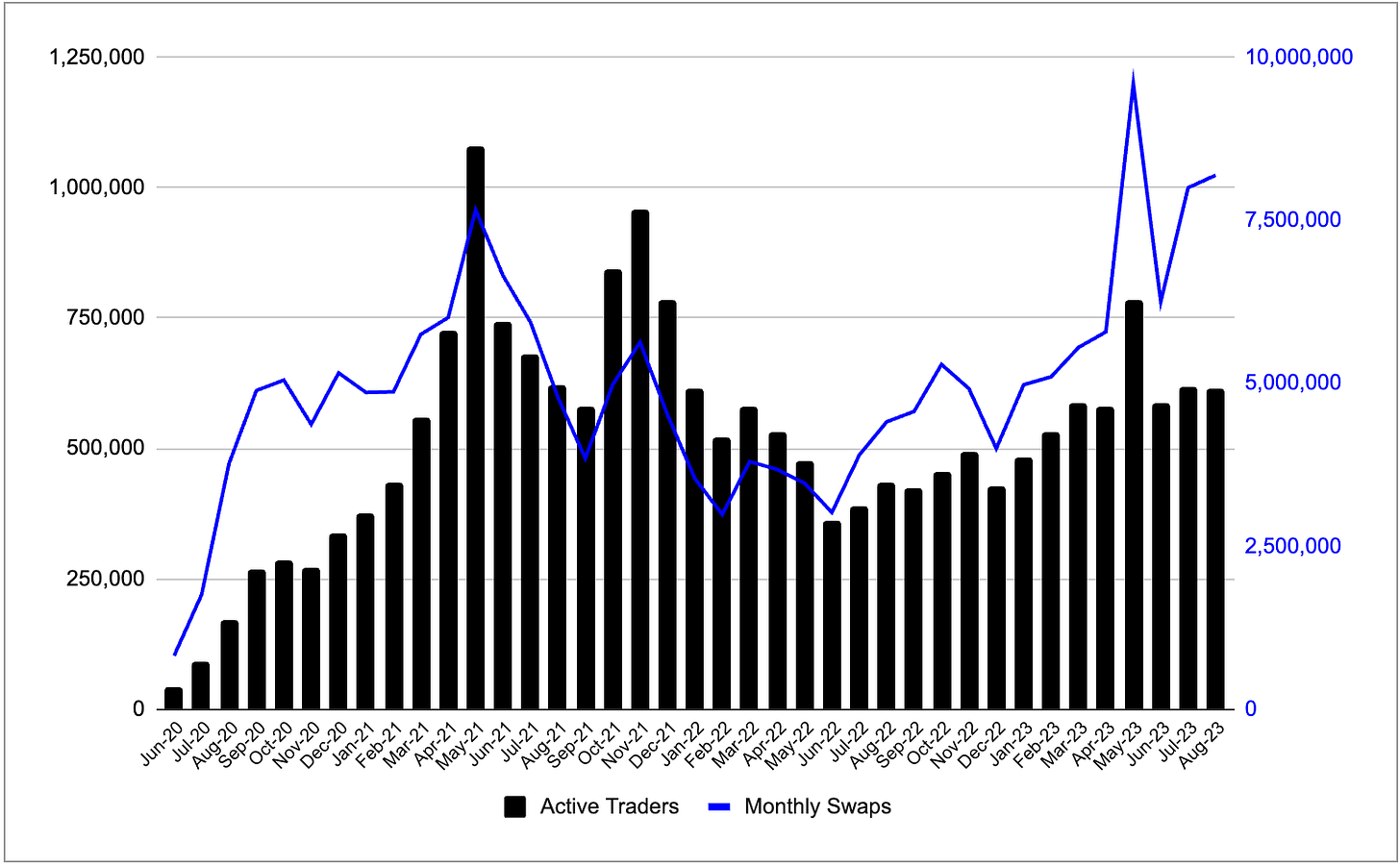

The months of May, July, and August 2023 have seen total swaps on DEXs hit ATHs, with over 8.5m monthly swaps across these three months, on average

Active traders (or users) of these DEXs haven’t gone away either, in fact, over the last year, active users of DEXs are up +41.9%

Most of this activity stems from the fact that traders are able to trade a range of long tail assets that are not listed on CEXs, but are permissionlessly listed on DEXs. While a share of these tokens are memecoins (which have been popular over the last few months), a large share are tokens that chose to be bootstrapped onchain

Technical Updates and Other Developments:

Uniswap announced v4, which will broaden the design surface area for trading onchain, as well as UniswapX, a cross-chain (and offchain) liquidity aggregator

These upgrades cement (an already cemented) Uniswap’s position as the clear market leader within the DEX space. There is no second best

Aerodrome Finance gained ~$170m in TVL, becoming the top protocol by TVL on Base, just 3 days since launch

Ambient Finance has a novel take on designing liquidity pools, combining them all into a single DEX contract, similar to Uniswap v4’s singleton contracts

Conclusion:

Contrary to popular belief, DEX activity isn’t dying. While volumes (in $ terms) are down, actual usage (# of monthly swaps), and users (active traders), have been on a steady incline, over the last year. Stalwarts like Uniswap continue to upgrade their product to maximize efficiency, cost and UX, while newer DEXs like Ambient aim to rethink the landscape in general, making for an interesting next few years in the DEX design space.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital