The Weekly Airdrop: 0x83

September 22, 2023 // Overall Market (0.03%): Mt. Gox repayment date pushed to 2024, Pocket Network goes modular, Optimism Foundation sells 116M tokens

MARKET UPDATE

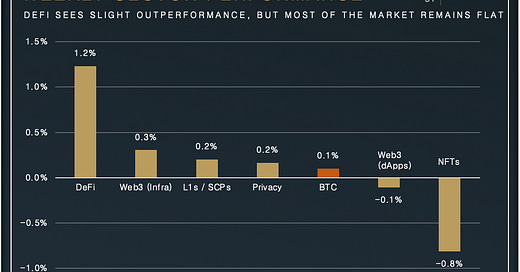

BTC started the week on a positive note, breaking range highs and briefly trading above $27k before a hawkish Fed tapered the rally with most FOMC participants signalling the expectation of one more rate hike before year end. ETH was notably weaker than BTC throughout the week as the ETHBTC ratio declined (-3.1%) to 0.059 by the end of the period. The relative weakness in ETH comes as multiple dormant addresses became active and had begun moving coins to exchanges early in the week.

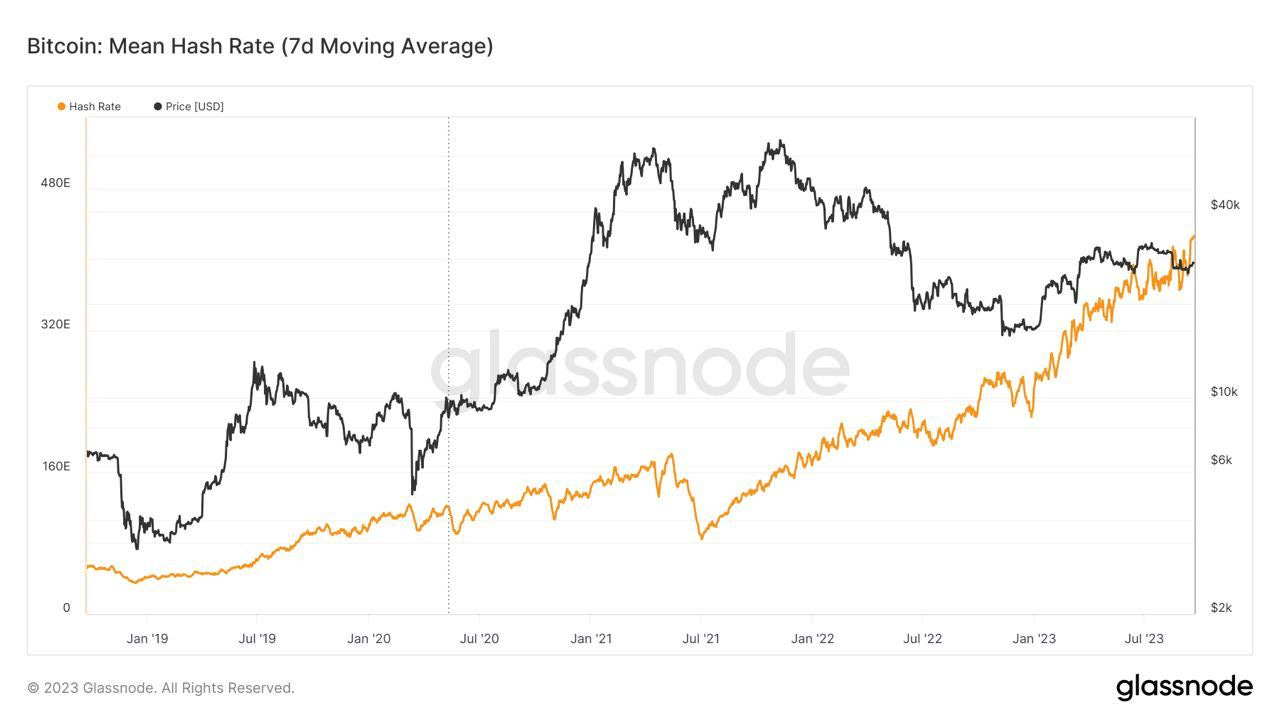

BTC hashrate, meanwhile, continues to rise, hitting all-time highs this week.

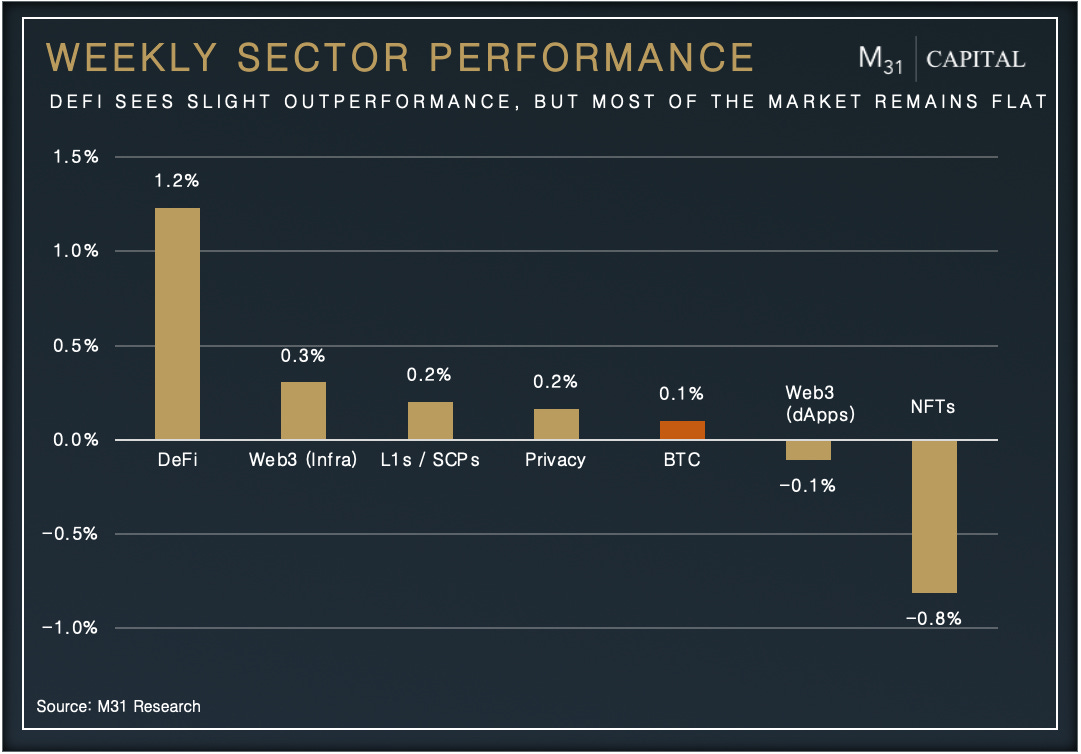

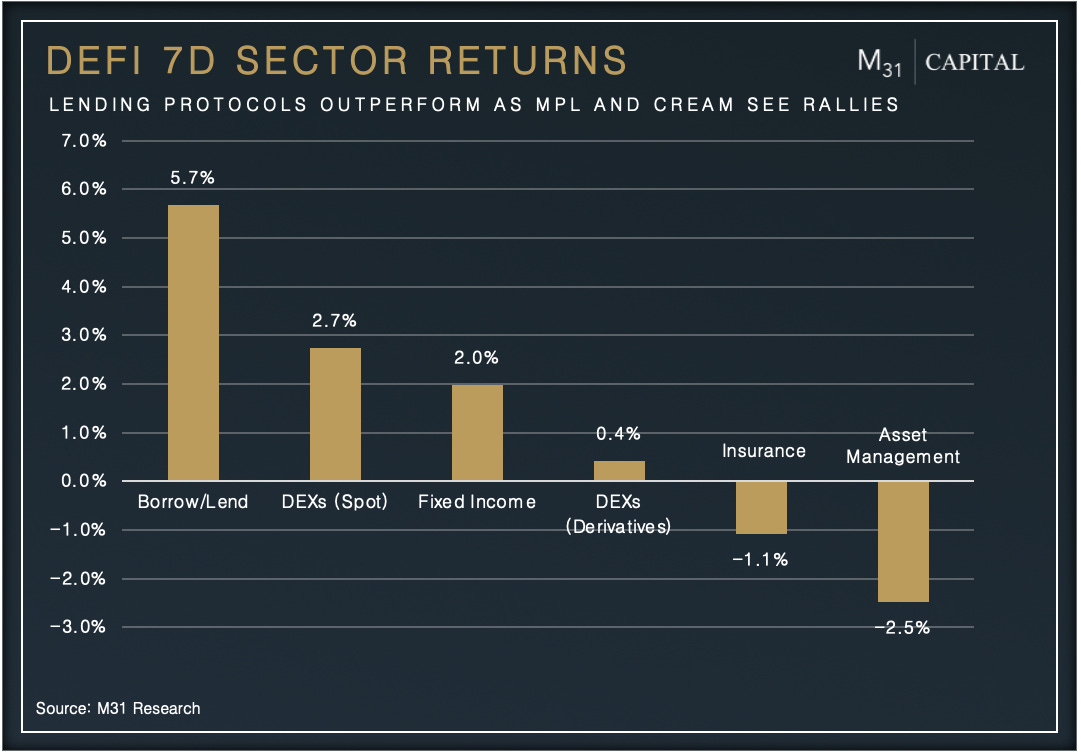

DEFI OVERVIEW

Onchain Activity

FOLD (+138.8%) rallied on the back of mevETH launch, an LST that will provide high yields on staked ETH using non predatory MEV strategies. FOLD will accrue value on all protocol fees, and will be used to bid for access to Manifold’s SecureRPC API

Maple Finance launched their cash management solution on Solana. This product, aimed at DAO treasuries has seen $10M in deposits initially, will provide RWA exposure to Treasury Bills. MPL has performed well following the successful launch (+9.6%) over the week

Offchain Activity

The Mt. Gox creditor payments that were scheduled to be completed by October 31, 2023 have been pushed to 2024. This removes a significant amount of potential BTC selling as we head towards year end while the US Government is expected to sell off seized BTC from the Silk Road

WEB3 OVERVIEW

Onchain Activity

POKT (+22.0%): Pocket Network rallied +22.0% over the last week after the network announced that they will be transitioning to a rollup, using Celestia as a DA layer, increasing services offered, utility to the token, and increased compatibility with the ecosystem

Offchain Activity

Optimism entered into a private token sale agreement, selling ~116m OP tokens among seven undisclosed purchasers. These tokens are coming out of the allocation for the foundation’s working budget

FEATURED

What’s Up With DeFi Derivatives DEXs

By: Mohit Pandit (@kidponga)

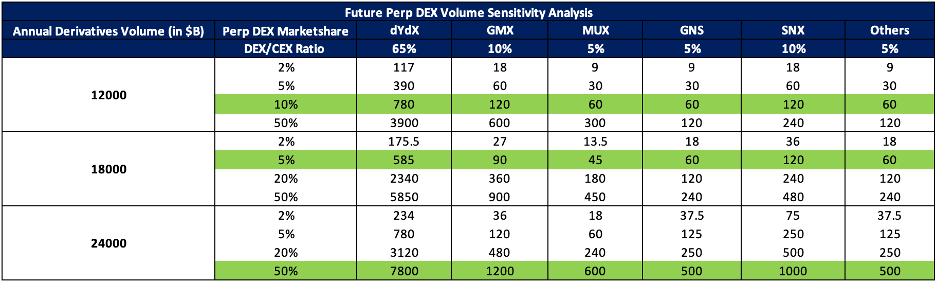

While centralized exchanges are the main providers of leverage within crypto markets over the last couple of years, onchain alternatives like dYdX, GMX, and Synthetix, have set out to compete with centralized exchanges and have been able to establish product market fit among onchain traders while offering different trade-offs vs. CEXs. It is clear that the demand for leverage can be fulfilled (at some scale) onchain.

Derivs DEXs have proven market fit and are likely to see volumes return to 2022 levels and beyond over the next few years, as market conditions get better, and volatility increases.

Read the full report from Mohit Pandit below:

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital