The Weekly Airdrop: 0x89

November 3, 2023 // Overall Market +4.0%, Celestia goes live, BTC makes new YTD high, MSTR adds more BTC, & SBF found guilty on all 7 counts

2024 Academy: Summer Internship Program

Web3 Summer Internship program.

Work, learn, and live in the Web3 Citadel Dubai

Application Deadline: December 1, 2023

MARKET UPDATE

Crypto markets surged for the second week in a row, with BTC notching another YTD high of $35,993, breaking above the $34.8k resistance area before falling back down into the range from the prior week early Thursday morning.

Ether has struggled to make any significant gains relative to BTC with the ETHBTC ratio sitting at .05 at the time of writing. This is a significant level which has acted as support throughout 2022. Given the strong catalysts for BTC in the near future it would not come as a surprise to see continued strength and a slower rotation into ETH and other tokens further out on the risk curve.

DEFI OVERVIEW

DeFi saw significant activity during the month the past week, which can be seen in Ethereum gas fees, which doubled towards the end of the month going from 11-14 Gwei up to 22-30 Gwei. During the week Aave USDC borrow rates also spiked from 13% to 22%, which is indicative of increasing leverage and the utilization of the USDC available for borrowing passed 90%.

Dexs

This activity across the DeFi sector drove strong Dex performance as can be seen with GMX and dYdX volumes surging resulting in increased fees across the board. In the past 7 days dYdX pulled in $1.2m in fees while GMX generated $991K. The fee revenue may not seem that different on the surface but the notable divergence between the two exchanges is the significantly higher take rate on GMX.

GMX handled $703m in trading volume in the past 7 days while dYdX did $4.6b. There are a few things to note, first and foremost GMX’s GLP liquidity model vs dYdX’s traditional CLOB. Going forward as GMX has launched V2, which separates out different GLP assets for liquidity providers, it will be important to watch how that scales in volume as we see there is a preference among some traders to have more predictable liquidity even if it comes at a much higher cost.

WEB3 OVERVIEW

The upward momentum in various Web3 sectors continues unabated, with Arweave +37.6% this week, notably outshining the rest as the burgeoning demand for on-chain storage significantly heats up, showcasing a robust appetite for decentralized data preservation solutions.

Helium

The Helium community recently celebrated the launch of Helium Wallet App v2.3.0, which added several new features and updates. Among the new additions is an explorer by Relay Wireless. Geared towards large-scale deployers and enterprises, Relay Wireless contributes robust tools that strengthen the Helium ecosystem. Users can explore this new tool within the updated Helium Wallet App.

The increased interest and technological advancements in the Helium network appear to correspond with growing demand. Helium's demand-side protocol fee has increased by 23% week-over-week (WoW) and 27% month-over-month (MoM). The rise in fees suggests that the network's new features and partnerships, such as the one with Relay Wireless, are adding value, thereby making the network more attractive to users and investors.

HIGHLIGHT: Celestia (TIA)

Celestia unveiled its mainnet release on Oct 31, heralding the advent of the modular era. TIA tokens are now available for users to run nodes, earn, and stake.

Since the Mainnet's launch, Celestia has experienced robust activity. The network according to celenium has registered a total of 280,731 transactions. Additionally, it has generated 2.81 megabytes of blob size. The platform has also accrued 15,300 TIA fees, further underscoring its growing adoption.

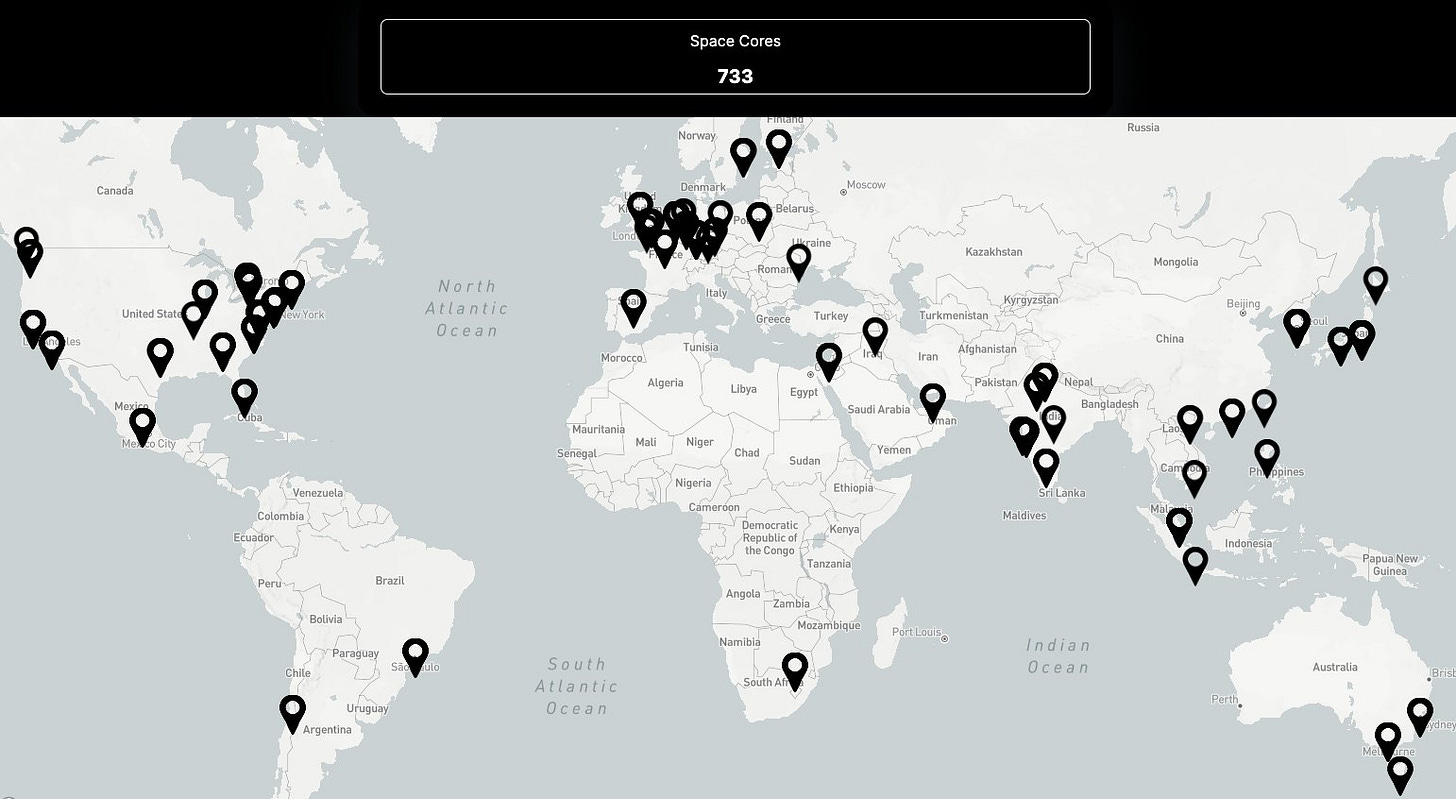

As of now, Celestia's global network infrastructure includes 733 space cores running light nodes. With this strong foundation, we anticipate even greater expansion in the future.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital