The Weekly Airdrop: 0x91

November 17, 2023 // Overall Market (-2.8%), Blackrock files for a spot Ether ETF, OKX launching their own L2, dYdX chain handles first trades, NYDFS rolls out stricter guidelines for token listings

2024 Academy: Summer Internship Program

Web3 Summer Internship program.

Work, learn, and live in the Web3 Citadel Dubai

Application Deadline: December 1, 2023

** Only 2 more weeks before the application window closes

MARKET UPDATE

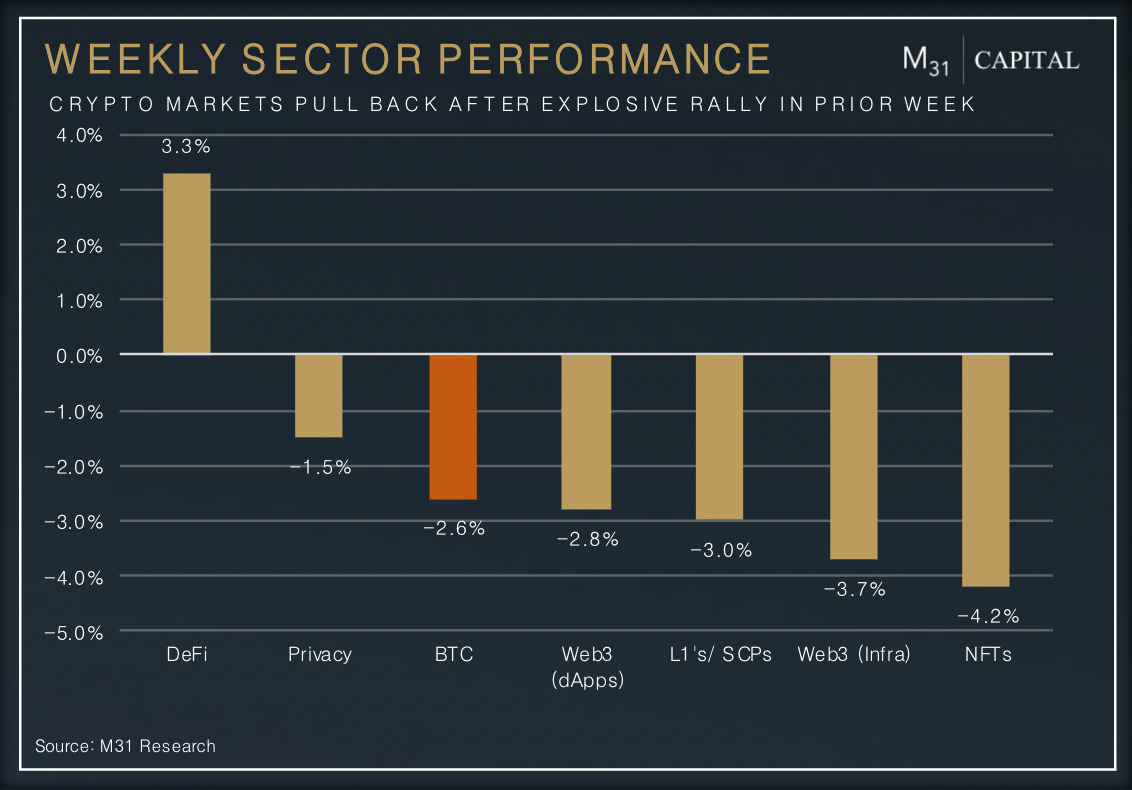

This week majors both ended down with BTC (-2.6%) and ETH (-6.0%). While BTC has continued to make new highs in the past month, ETH has been a laggard just managing to make a run to the yearly high of ~$2,125. ETH/BTC is sitting at .053 with .05 acting as support on a yearly timeframe. It is likely we see BTC strength relative to ETH through the end of the year and into Q1 as we are still in the early stages of this cycles run.

DEFI OVERVIEW

Activity remained strong in the DeFi sector this past week but after the explosive price action in the previous period we have seen mixed returns across sectors, with spot Dexs and fixed income the strongest performers.

Vertex Protocol

Vertex protocol, a spot and perp exchange on Arbitrum, continues to see increased growth, volumes up from ~$50m per day in October to $240m on the same day in November with a peak of $420m in volume. Vertex’s fees have grown significantly during this period and in the past week peaked at $90.8k collected in a 24h period.

The VRTX token will launch on November 20th at the conclusion of their weeklong liquidity bootstrapping auction which has seen $10.4m in TVL supplied in both locked VRTX earned through trading rewards and USDC, which accounts for $5.2m of the total, implying a VRTX launch price of 0.43c.

WEB3 OVERVIEW

Over the past week, the Web3 sector's performance has showcased a late-mover surge with Identity assets finally catching momentum, leading with an 11.4% return after a period of stagnation. In contrast, early movers like Data Services have experienced a pullback, with losses mounting to (-12.4%), suggesting a market correction within the sector.

Akash

The Akash network has shown a positive trend over the past week, with a price increase of 3.8%. Concurrently, the protocol's demand-side fees have surged by 48.2% to $5,167, indicating a robust rise in network activity.

The Akash Mainnet 8, expected to launch on November 20, 2023, promises a transformative upgrade to enhance network capabilities. It will usher in version 0.28.0, featuring a market store advancement that empowers providers to precisely offer GPU models, streamlining resource allocation. The upgrade, hinging on Proposal 237's approval, simplifies the update process for validators and RPCs, enabling automatic binary downloads for a seamless transition.

HIGHLIGHT: Redstone

Redstone represents a significant advancement in blockchain technology. It is the first plasma-implementation for the OP Stack, designed to be a highly cost-effective chain for onchain games, worlds, and other ambitious applications. Differing from traditional optimistic rollups, Redstone does not post the entire input state to L1 (Layer 1). Instead, it posts a data commitment hash, with the actual input state stored offchain by a Data Availability Provider. This method significantly reduces the data size posted to the Ethereum mainnet, from 120 kilobytes per batch to just 32 bytes, decreasing the L1 security cost by over 90%. Redstone's future upgrades could further reduce costs with merklelized commitments.

The development of Redstone was a collaborative effort between the Lattice team and Optimism, with the aim of joining the Superchain and contributing as core developers to the OP Stack. This collaboration focuses on open-source software, common standards, and modular integrations, promoting horizontal scalability and shared security across multiple chains. Redstone's design aligns with these principles, offering compatibility with MUD (a framework for onchain applications), optimized RPCs, and indexers to enhance the developer experience. The public launch of the Redstone testnet marks a significant step towards realizing the potential of ambitious applications and onchain worlds.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital