The Weekly Airdrop: 0x98

Jan 5, 2024 // $700m liquidated in flash sell-off, Celsius unstakes 200k ETH as part of restructuring, Huddle builds physical node for DePIN communications

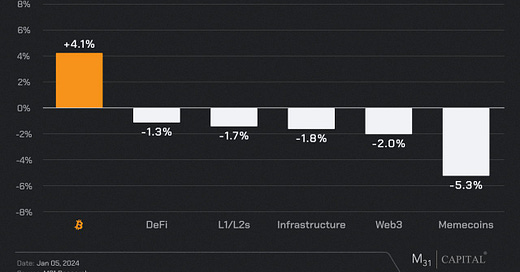

BTC kicked off the New Year with a bang, pushing to new highs of $45,928 in early week trading. The run up was short lived as crypto market tumbled pre US cash open Wednesday, with BTC sliding as much as (-8.8%) and ETH following suit down (-11.1%) as a large amount of leverage was flushed from the system. This move resulted in $700m of long liquidations in the span of a few minutes and reset sky high funding rates across the board for majors and alts. Over the next 24 hours we saw a sharp recovery as the end of year run up in leverage was cleansed, aggressive bids came in for TIA +30.1%, INJ +15.4%, and AKT +10.6%.

Dymension (DYM): TBD

Shared settlement layer Dymension launched its mainnet and introduced DYM, its native token, which will be pivotal for security and ecosystem growth. The Genesis Rolldrop allows eligible addresses to claim DYM until January 21, 2024. Significant DYM allocations are dedicated to supporters of Celestia, Ethereum L2s, Cosmos, and Solana, recognizing their contributions to Dymension's development. DYM price action (along with TIA) will be a good proxy for the modular blockchain thesis moving forward.

USD Coin (USDC): +0.0%

The USDC stablecoin briefly lost its $1 peg on Binance, dropping to $0.74 due to a market-wide sell-off and a report casting doubt over the approval of a spot bitcoin ETF. This depegging occurred three times between 12:10 and 12:21 UTC, each time quickly rebounding to $1.

Synthetix (SNX): (-15.1%)

The SNX stakers of Synthetix.io experienced approximately $2 million in losses due to an incident involving TRB (Tellor Tributes). This incident was attributed to a significant increase in open interest for TRB, which rose from $250,000 to $12.5 million, without proper adjustments in risk controls. The situation was exacerbated by a lack of balance between spot and perpetual prices and the failure of the funding rate mechanism to respond.

Ethereum Name Service (ENS): +23.3%

ENS gained attention following Vitalik Buterin's endorsement of its importance for layer-2 blockchain integration. Vitalik emphasized ENS's role in improving user experience in decentralized finance by facilitating easier domain registrations and transactions on Ethereum. The ENS platform has over 2.1 million registered domains and 800,000 unique users.

Hivemapper (HONEY): +103.4%

In 2023, the Hivemapper network achieved significant growth by mapping 6.8 million unique road kilometers and a total of 103 million road kilometers. The network was supported by 33,676 contributors who focused on map and AI training, with an average weekly contribution of 700-900 kilometers per driver. This expansion sets a promising foundation for further advancements in 2024.

Syntropy (NOIA): +48.1%

Syntropy is experiencing significant growth with 100 new wallets being created daily. The project is progressing towards completing its next roadmap phase in Q1 2024, focusing on the billion-dollar blockchain data access market. Syntropy is also poised to establish partnerships with numerous DeFi projects and enable its Data Layer's tokenomic cycle with the upcoming mainnet launch.

THE NEWSROOM

Thorchain and Cosmos IBC take the lead in cross-chain volumes exceeding $7.3b combined

Arbitrum’s Layer 3 Orbit chains enable certain ERC20 tokens as gas, increasing utility

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital