The Weekly Airdrop: 0x99

Jan 12, 2024 // Spot ETF's approved and begin trading, Vitalik hints at increasing the gas limit per block, Fox Corp taps Polygon for tracking the origination of news

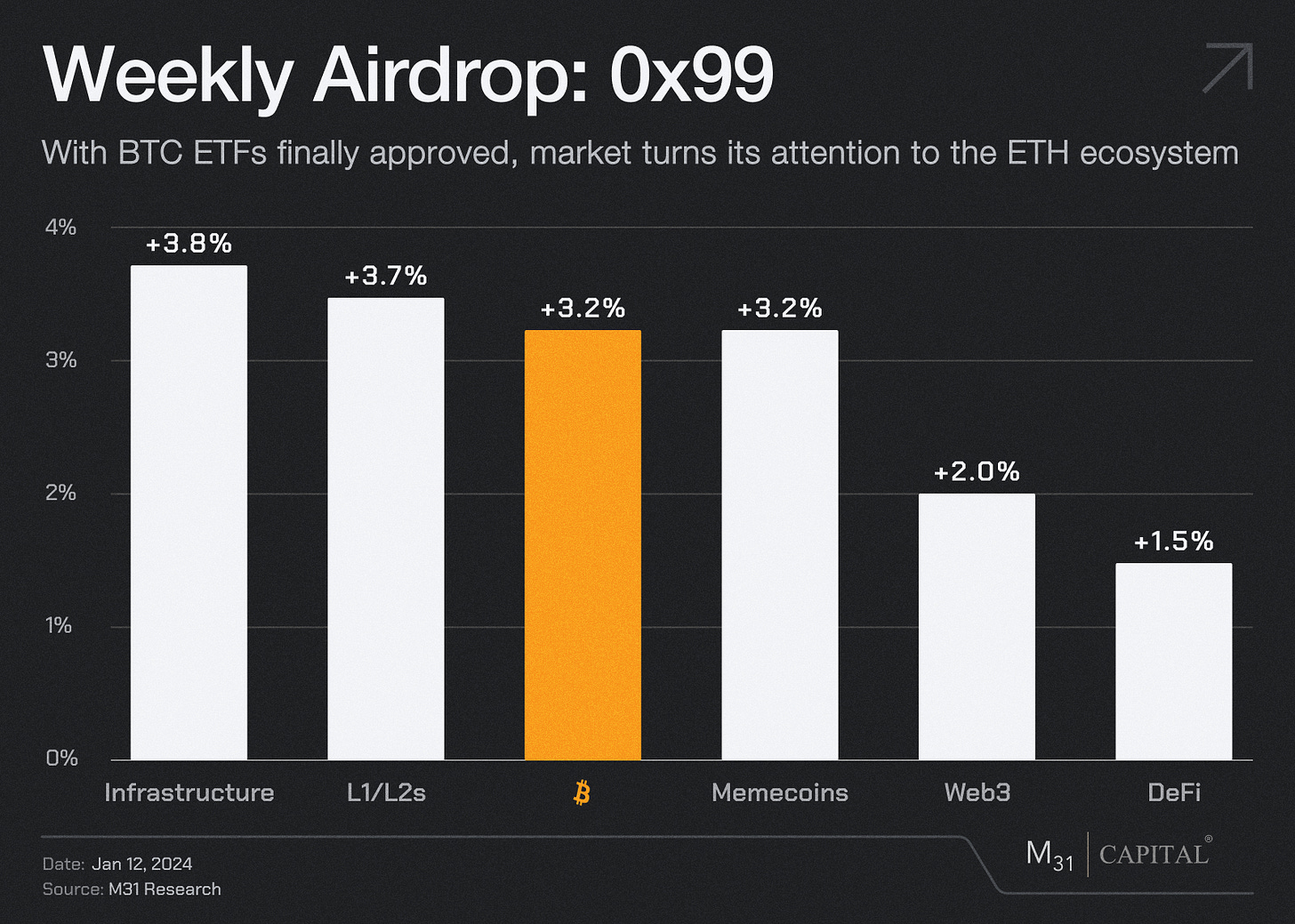

All eyes were on the Spot BTC ETF deadline this week as the SEC finally gave the greenlight, concluding a decade long push from crypto natives to make the asset more accessible for traditional investors. This was a major milestone in uniting the regulated investment world with the crypto space. There are a wide range of estimates as to what flows will look like in the coming weeks and months, but on day one, volumes eclipsed $1.2B in first 30 minutes of trading. The rising tide is also benefitting the broader market, as investors now begin to speculate about a spot ETH ETF, which could come as soon as May. BTC is currently up 9.6% from the lows on Monday, while ETH is up 21.9% over the same period. TIA is pushing up to new highs, trading as high as $17.35 early Thursday morning.

Aave (AAVE): +8.8%

Money market protocol Aave held a vote to check the community temperature on adding support for Paypal’s stablecoin, PYUSD. Currently 99% of the community is in favor of adding support which would broaden adoption in the DeFi space beyond just Curve to the second major protocol to embrace traditional finance companies playing a role. PYUSD currently has a circulating supply of $293m, up from ~$150m at the start of December.

Berachain (BGT): TBD

Berachain has launched its public testnet built using Cosmos SDK and follows a Proof of Liquidity concept. Berachain has raised $42m in funding and is expected to go live this year.

Injective (INJ): (-3.7%)

Injective has rolled out its “Volan” upgrade, which is focused on adding support for RWA’s as the trend remains strong. This upgrade also integrates with Cosmos IBC, which will allow cross chain transactions across the Cosmos ecosystem and improve liquidity sourcing.

Flux (FLUX): +1.9%

Since launching its FluxEdge Proof of Useful Work (PoUW) alpha testing program in mid-December, the decentralized computing platform has amassed nearly 4,000 GPUs, quickly making it one of the largest GPU projects in web3. When the product is ready for public use, Flux plans to direct its sales focus to SMB and enterprise customers.

Bittensor (TAO): (-4.3%)

Bittensor had its first governance proposal this week, titled BIT1, which aims to better incentivize subnet development and utility optimization. Although the final terms are still being discussed, the basic premise is for each subnet to have its own native token, which should theoretically better compensate subnets that provide more utility.

Aleph.im (ALEPH): +47.3%

Aleph.im, the decentralized storage and compute platform, released its 2024 roadmap this week, highlighting its plans to add pay-as-you-go capabilities, a native oracle, GPU support for virtual machines, IPFS on virtual machines executors, confidential virtual machines, and support for new EVM chains.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital