The Weekly Airdrop: 0x64

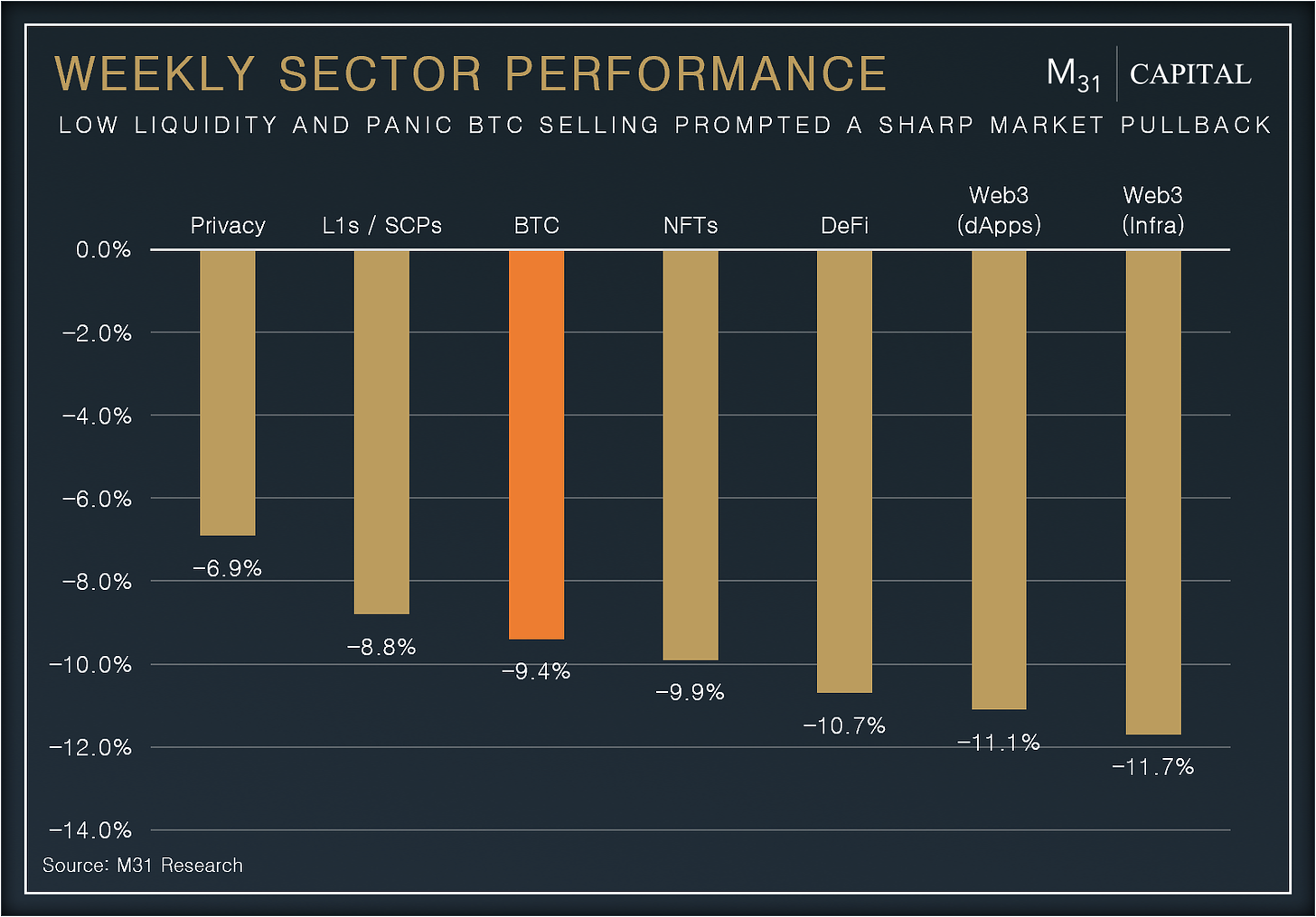

May 12, 2023 // Overall market (-8.8%) as MMs wind down U.S. ops, CPI falls to 4.9%, Bittrex files for Chapter 11 bankruptcy, and Bitcoin approaches an inflection point with BRC-20

MARKET UPDATE

The overall market tumbled (-8.8%) due to Bittrex's bankruptcy filing and panic selling of BTC, prompted by rumors of the U.S. government selling their BTC holdings worth around $3bn. While there was a temporary recovery when the YoY CPI reported at 4.9%, lower than the anticipated 5.0%, this uplift didn't sustain for long.

Jane Street Group and Jump Crypto are winding down their market making operations in the U.S., in the wake of further U.S. regulation crackdowns, with Binance U.S. the next likely domino to fall. This may lead to a period of much lower liquidity, and subsequently, more volatility.

ETH outflow from CEXs reached a monthly high of 331.0k ETH per day, with over 1.4m ETH flowing off exchanges since May 1.

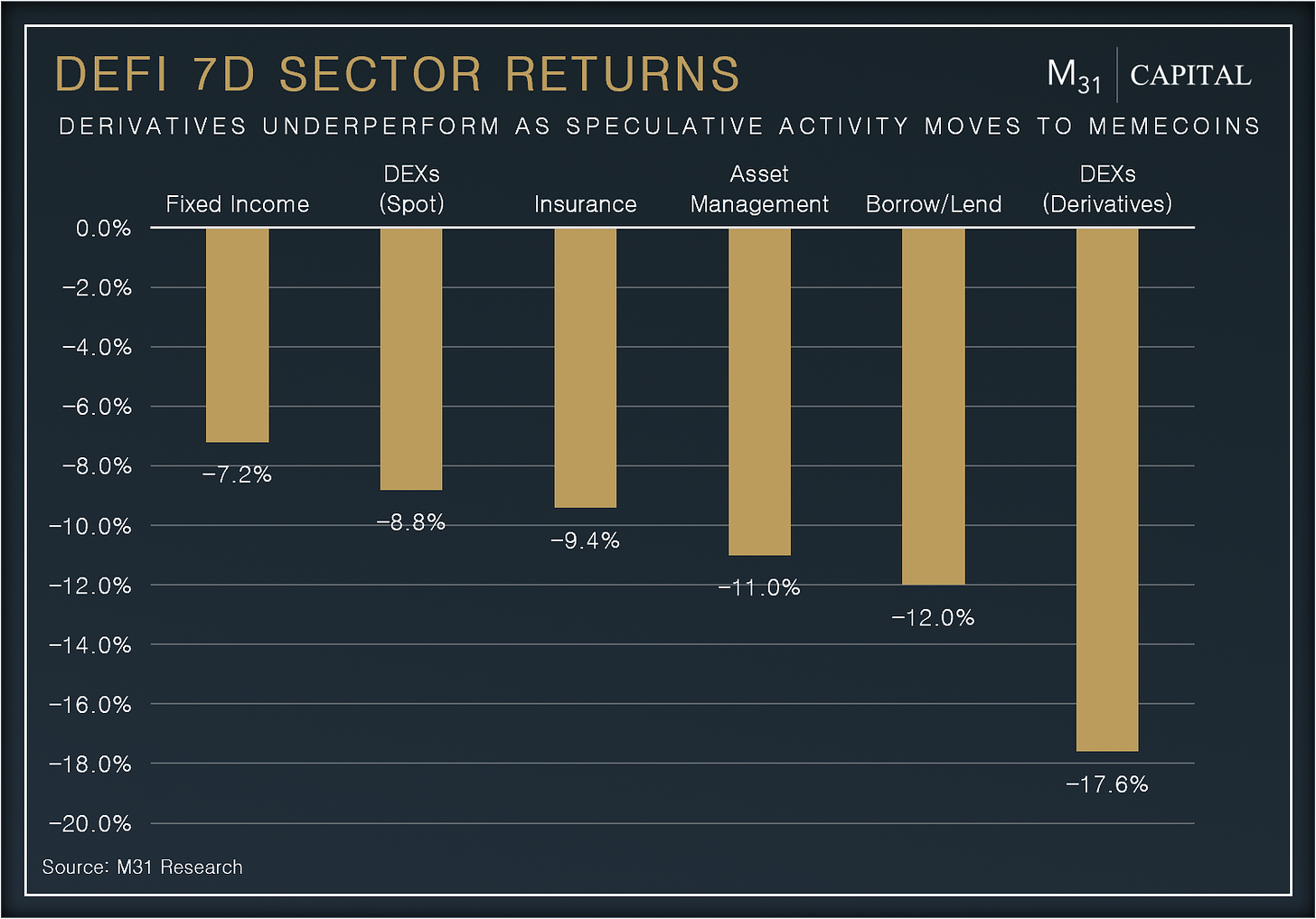

DEFI OVERVIEW

Onchain Activity

Arbitrum is set to send its rollup’s surplus fees, which is the difference between collected fees on L2 and the cost of publishing transactions to L1, to the Arbitrum DAO. In total, the rollup has generated ~3,352 ETH in profit over the last 3 months

Uniswap’s fee switch discussion reemerges as trade volume significantly increased, driven by memecoin interest. Transactions on the platform reached an ATH of 393.9k per day with ~$12.74m spent in gas per day, which is even more activity than the peak of the last bull run, in Nov-21

Offchain Activity

Wormhole will enable BTC to be bridged directly to Solana, and other chains, providing more utility for the Solana ecosystem, including speculative activity on Ordinals

MakerDAO released its Endgame plans, aiming to launch 6 new SubDAOs, a new stablecoin, upgrades to the MKR token, and powerful AI tools to help its community better understand the protocol

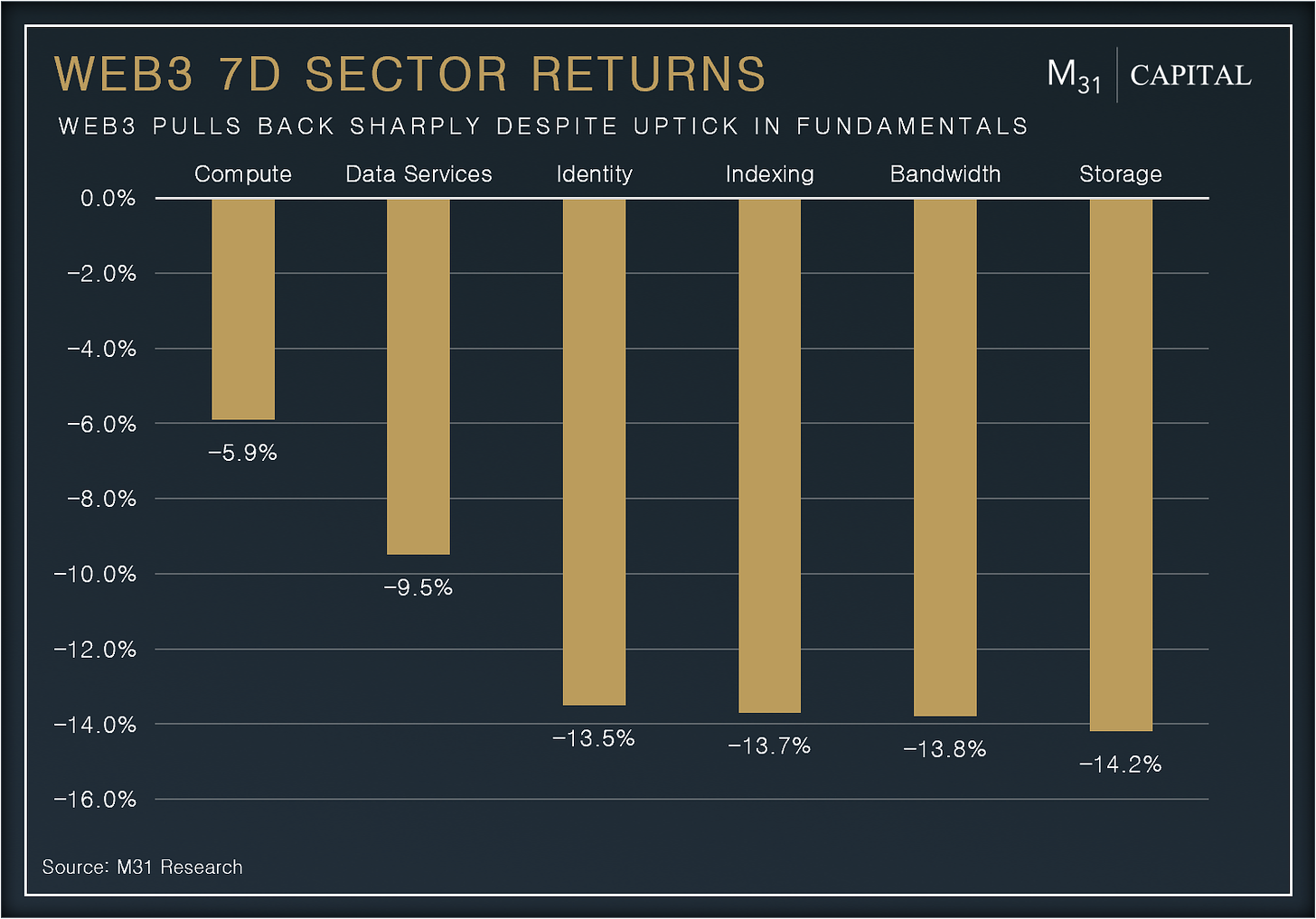

WEB3 OVERVIEW

Onchain Activity

Pocket Network’s activity is soaring. While hitting new daily active relay highs of ~2.1bn, weekly relays hit 11.3bn, +29.1% w/w. This level of activity will allow the protocol to reach a higher POKT burn rate than previously projected

Helium’s IOT coverage expanded to 27 new cities worldwide with a total number of hotspots reaching 991.2k after the migration to Solana. The number of Helium mobile radios has grown +10% q/q to over 7,400

Offchain Activity

Cosmos Hub is entering a new era with the launch of Neutron, the first consumer chain to implement Replicated Security. Cosmos Hub validators provide robust security for Neutron's block production, bringing higher staking rewards for ATOM delegators

We touched upon the importance of shared sequencers for rollups previously. Privacy-focused rollup, Aztec, is making its first move in this direction, collecting proposals for different shared sequencing solutions, to help the network decentralize

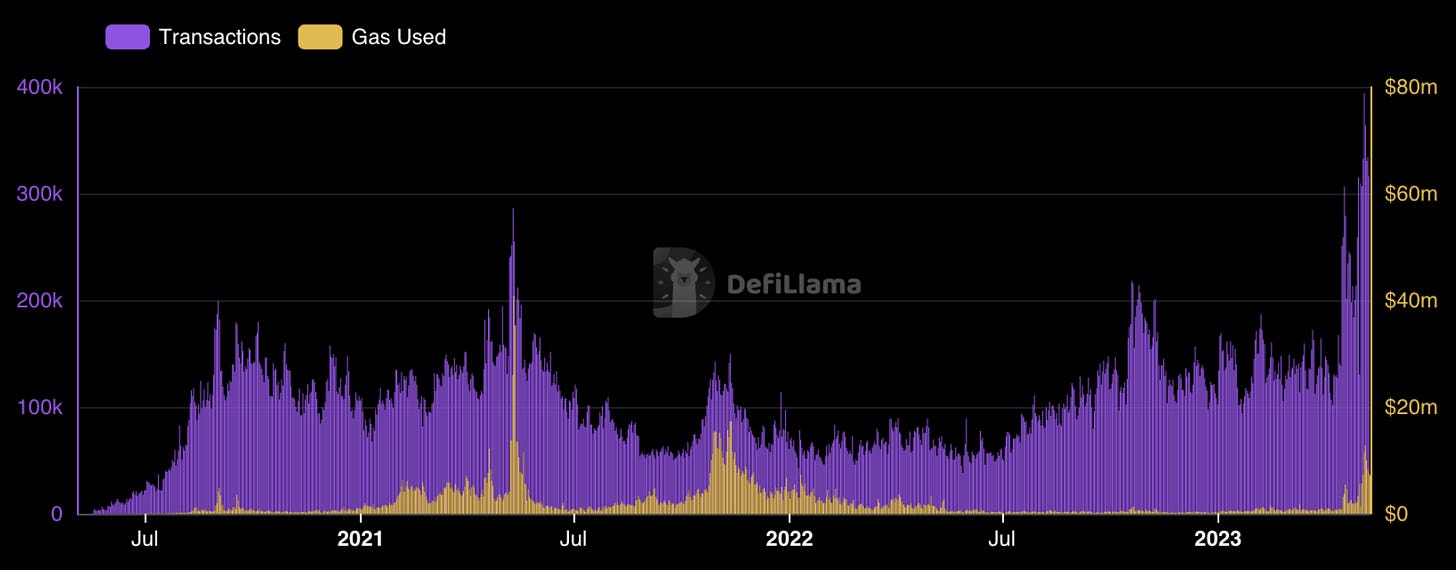

Bitcoin and BRC-20

The Taproot upgrade that went live in November ‘21, had a few unintended consequences, most notably: the ability for individual satoshis (the smallest unit of BTC) to store different types of data. This had major implications for Bitcoin Network as a whole, and we have seen this rapidly evolve, especially with BRC-20 tokens.

BRC-20 isn’t a token standard (like ERC-20) but rather a script that contains a token’s basic information (max supply, token ticker etc.) and enables tokens to be launched on the Bitcoin network, using the ordinals standard. For simplicity, think of brc20 tokens more like NFTs.

BRC-20 Tokens and The Impact on Bitcoin

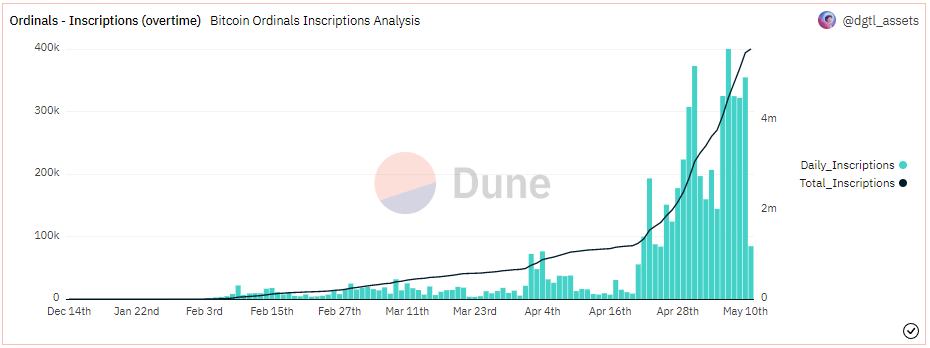

Over the past week, BRC-20 ‘minting’ and trading activity has gone parabolic, driven by a continuation of the memecoin craze, but on Bitcoin. This has led to several (some unintended, some welcome) second-order effects:

Network Congestion & High fees: 303,168 unconfirmed transactions in the mempool, and high transaction fees, at of an avg. of $16.1/tx

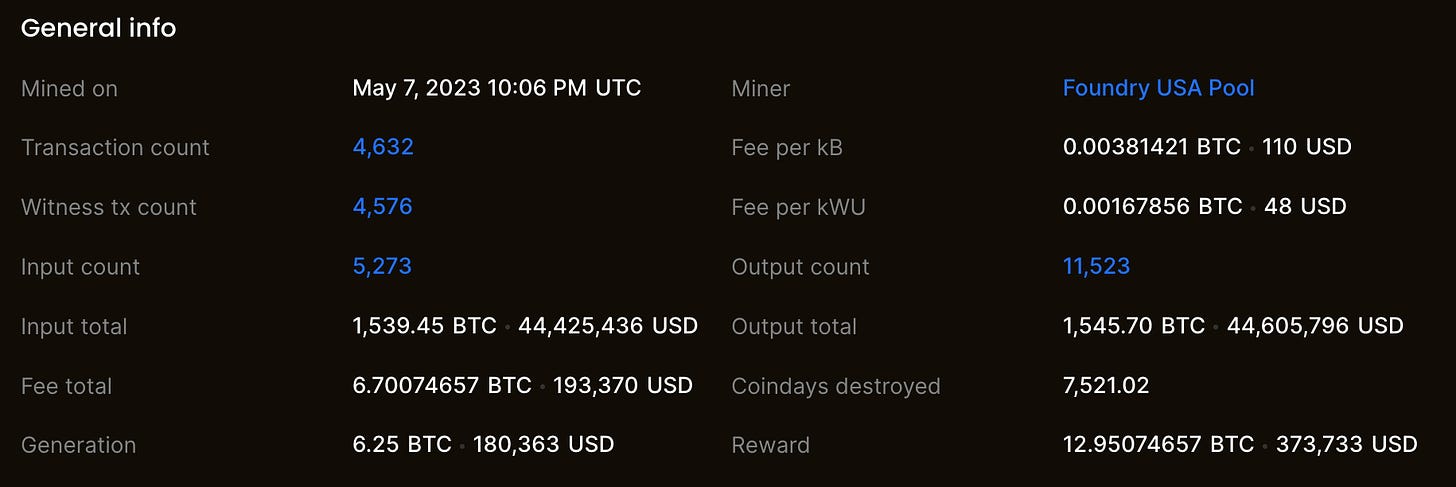

Network Revenue: The Bitcoin Network has earned $77.6m in revenue in May so far, +640.3% from 1 year ago. Last week, BRC-20 tokens contributed to 60.2% of all Bitcoin network fees

Miner Incentives: were higher from transaction fees than block rewards for the first time since 2021, making a strong argument that this standard is essential to sustain miner incentives

Conclusion

The Bitcoin network is currently adapting to an influx of demand, leading to higher transaction fees. Traditional Bitcoin advocates argue that this influx, largely due to BRC20 tokens, detracts from Bitcoin's original purpose as a decentralized store of value. Conversely, BRC20 token holders, collectively owning satoshis valued at about $425 million, staunchly defend their tokens' existence.

The BRC20 standard marks a significant evolution for Bitcoin, highlighting its potential as a secure, unalterable data storage platform. It contributes to the profitability of Bitcoin miners through increased transaction fees and draws new users to the network, enhancing its growth and reach.

THE NEWSROOM

About M31 Capital

M31 Capital is a global investment firm dedicated to crypto assets and blockchain technologies that support individual sovereignty.

Website: https://www.m31.capital/

Twitter: https://twitter.com/M31Capital